|

Franklin India Aggressive Hybrid Fund$$ (Erstwhile Franklin India Equity Hybrid Fund) As on August 29, 2025 |

|

|

An open ended hybrid scheme investing predominantly in equity and equity related instruments

SCHEME CATEGORY

Aggressive Hybrid Fund

SCHEME CHARACTERISTICS

65-80% Equity, 20-35% Debt

INVESTMENT OBJECTIVE

The investment objective of the scheme is to provide long-term growth of capital and current income by investing in equity and equity related securities and fixed income instruments.

DATE OF ALLOTMENT:

December 10, 1999

FUND MANAGER(S):

Rajasa Kakulavarapu (Equity)

Ajay Argal (w.e.f. October 4, 2024)

Chandni Gupta (w.e.f. March 07, 2024)

Anuj Tagra (w.e.f. March 07, 2024)

Sandeep Manam

(dedicated for making investments for Foreign Securities)

BENCHMARK:

CRISIL Hybrid 35+65 - Aggressive Index

| TURNOVER | |

| Portfolio Turnover | 83.16% |

| Portfolio Turnover (Equity)* | 23.33% |

| *Computed for equity portion of the portfolio. | |

| MATURITY & YIELD$ | |

| RESIDUAL MATURITY / AVERAGE MATURITY | 8.57 years |

| ANNUALISED PORTFOLIO YTM# | 7.42% |

| MODIFIED DURATION | 4.62 years |

| MACAULAY DURATION | 4.84 years |

| #Yields of all securities are in annualised terms $ Calculated based on debt holdings in the portfolio | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1

ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : |

Upto 10% of the Units may be redeemed without any

exit load within 1 year from the date of allotment. Any redemption in excess of the above limit shall be subject to the following exit load: 1.00% - if redeemed on or before 1 year from the date of allotment Nil - if redeemed after 1 year from the date of allotment |

| Different plans have a different expense structure | ||

| Growth Plan | Rs 266.4679 |

| IDCW Plan | Rs 28.6105 |

| Direct - Growth Plan | Rs 304.9689 |

| Direct - IDCW Plan | Rs 33.9891 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs 2245.11 crores |

| Monthly Average | Rs 2250.94 crores |

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Aerospace & Defense | |||

| Bharat Electronics Ltd | 5,10,000 | 1,883.94 | 0.84 |

| Agricultural Food & Other Products | |||

| Marico Ltd | 2,09,400 | 1,519.93 | 0.68 |

| Auto Components | |||

| Tube Investments of India Ltd | 60,000 | 1,776.96 | 0.79 |

| Amara Raja Energy And Mobility Ltd | 1,70,100 | 1,684.42 | 0.75 |

| ZF Commercial Vehicle Control Systems India Ltd | 9,878 | 1,390.33 | 0.62 |

| Automobiles | |||

| Mahindra & Mahindra Ltd | 86,000 | 2,751.57 | 1.23 |

| Tata Motors Ltd | 3,30,000 | 2,207.70 | 0.98 |

| Maruti Suzuki India Ltd | 13,000 | 1,922.83 | 0.86 |

| Banks | |||

| HDFC Bank Ltd* | 16,55,000 | 15,748.98 | 7.01 |

| ICICI Bank Ltd* | 8,58,500 | 12,000.11 | 5.34 |

| Axis Bank Ltd* | 5,80,000 | 6,062.16 | 2.70 |

| State Bank of India | 4,00,000 | 3,210.00 | 1.43 |

| IDFC First Bank Ltd | 4,00,000 | 271.96 | 0.12 |

| Beverages | |||

| United Spirits Ltd | 2,43,000 | 3,185.73 | 1.42 |

| Capital Markets | |||

| Angel One Ltd | 20,000 | 441.96 | 0.20 |

| Cement & Cement Products | |||

| Ultratech Cement Ltd | 28,000 | 3,539.20 | 1.58 |

| Chemicals & Petrochemicals | |||

| Chemplast Sanmar Ltd | 3,30,000 | 1,410.09 | 0.63 |

| Commercial Services & Supplies | |||

| Teamlease Services Ltd | 37,400 | 667.44 | 0.30 |

| Construction | |||

| Larsen & Toubro Ltd* | 2,10,000 | 7,562.10 | 3.37 |

| Consumer Durables | |||

| Crompton Greaves Consumer Electricals Ltd | 7,50,000 | 2,475.00 | 1.10 |

| Amber Enterprises India Ltd | 27,300 | 1,984.03 | 0.88 |

| Diversified Fmcg | |||

| Hindustan Unilever Ltd | 92,500 | 2,460.32 | 1.10 |

| Ferrous Metals | |||

| Tata Steel Ltd | 8,70,000 | 1,343.98 | 0.60 |

| Fertilizers & Agrochemicals | |||

| PI Industries Ltd | 55,000 | 2,032.14 | 0.91 |

| Finance | |||

| Cholamandalam Investment and Finance Co Ltd | 1,10,000 | 1,562.77 | 0.70 |

| PNB Housing Finance Ltd | 1,80,000 | 1,356.48 | 0.60 |

| Financial Technology (Fintech) | |||

| PB Fintech Ltd | 1,45,000 | 2,567.66 | 1.14 |

| Gas | |||

| GAIL (India) Ltd | 17,67,000 | 3,058.15 | 1.36 |

| Healthcare Services | |||

| Apollo Hospitals Enterprise Ltd | 44,000 | 3,348.40 | 1.49 |

| Metropolis Healthcare Ltd | 1,00,000 | 2,188.50 | 0.97 |

| Industrial Products | |||

| Kirloskar Oil Engines Ltd | 1,61,776 | 1,453.48 | 0.65 |

| Insurance | |||

| HDFC Life Insurance Co Ltd | 3,19,500 | 2,466.70 | 1.10 |

| ICICI Lombard General Insurance Co Ltd | 75,000 | 1,379.70 | 0.61 |

| IT - Software | |||

| Infosys Ltd* | 4,40,000 | 6,466.24 | 2.88 |

| HCL Technologies Ltd | 3,25,000 | 4,728.10 | 2.11 |

| Leisure Services | |||

| Lemon Tree Hotels Ltd | 14,83,000 | 2,459.26 | 1.10 |

| Jubilant Foodworks Ltd | 3,20,000 | 2,008.80 | 0.89 |

| Sapphire Foods India Ltd | 5,27,000 | 1,723.55 | 0.77 |

| Petroleum Products | |||

| Reliance Industries Ltd* | 4,60,000 | 6,243.12 | 2.78 |

| Pharmaceuticals & Biotechnology | |||

| Sun Pharmaceutical Industries Ltd | 1,90,000 | 3,029.55 | 1.35 |

| Eris Lifesciences Ltd | 1,35,000 | 2,430.27 | 1.08 |

| Power | |||

| NTPC Ltd | 10,15,000 | 3,324.63 | 1.48 |

| CESC Ltd | 12,50,000 | 1,902.38 | 0.85 |

| Realty | |||

| Prestige Estates Projects Ltd | 1,10,000 | 1,717.98 | 0.77 |

| Retailing | |||

| Eternal Ltd | 15,00,000 | 4,709.25 | 2.10 |

| V-Mart Retail Ltd | 2,20,000 | 1,633.72 | 0.73 |

| Telecom - Services | |||

| Bharti Airtel Ltd* | 3,53,000 | 6,667.46 | 2.97 |

| Indus Towers Ltd | 4,15,000 | 1,405.19 | 0.63 |

| Textiles & Apparels | |||

| Pearl Global Industries Ltd | 89,961 | 1,109.67 | 0.49 |

| Transport Services | |||

| Interglobe Aviation Ltd | 34,000 | 1,919.64 | 0.86 |

| Unlisted | |||

| Numero Uno International Ltd | 27,500 | 0.00 | 0.00 |

| Globsyn Technologies Ltd | 27,000 | 0.00 | 0.00 |

| Total Equity Holdings | 1,52,393.52 | 67.88 | |

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of Assets |

| Jubilant Bevco Ltd* | CRISIL AA | 10,418.41 | 4.64 |

| Jubilant Beverages Ltd* | CRISIL AA | 7,434.35 | 3.31 |

| Bharti Telecom Ltd* | CRISIL AAA | 6,606.13 | 2.94 |

| Poonawalla Fincorp Ltd | CRISIL AAA | 5,153.57 | 2.30 |

| Embassy Office Parks Reit | CRISIL AAA | 4,572.05 | 2.04 |

| Jamnagar Utilities & Power Pvt Ltd | CRISIL AAA | 2,638.87 | 1.18 |

| Summit Digitel Infrastructure Ltd | CRISIL AAA | 2,598.43 | 1.16 |

| Bajaj Finance Ltd | IND AAA | 1,057.98 | 0.47 |

| Kotak Mahindra Investments Ltd | CRISIL AAA | 1,035.95 | 0.46 |

| Total Corporate Debt | 41,515.73 | 18.49 | |

| Power Finance Corporation Ltd | CRISIL AAA | 2,590.73 | 1.15 |

| REC Ltd | CRISIL AAA | 1,958.11 | 0.87 |

| Small Industries Development Bank Of India | CRISIL AAA | 524.57 | 0.23 |

| Total PSU/PFI Bonds | 5,073.41 | 2.26 | |

| 6.90% GOI 2065 (15-APR-2065) | SOVEREIGN | 5,974.70 | 2.66 |

| 6.68% GOI 2040 (07-JUL-2040) | SOVEREIGN | 4,909.03 | 2.19 |

| 6.84% Andhra Pradesh SDL (04-Jun-2038) | SOVEREIGN | 2,442.55 | 1.09 |

| 7.82% Jammu & Kashmir SDL (28-Aug-2042) | SOVEREIGN | 2,040.12 | 0.91 |

| 7.77% West Bengal SDL (28-Aug-2046) | SOVEREIGN | 2,036.45 | 0.91 |

| 7.75% West Bengal SDL (28-Aug-2047) | SOVEREIGN | 2,025.18 | 0.90 |

| 5.63% GOI 2026 (12-APR-2026) | SOVEREIGN | 510.79 | 0.23 |

| 7.10% Rajasthan SDL (26-Mar-2043) | SOVEREIGN | 82.68 | 0.04 |

| 7.32% Chhattisgarh SDL (05-Mar-2037) | SOVEREIGN | 54.45 | 0.02 |

| 7.32% West Bengal SDL (05-Mar-2038) | SOVEREIGN | 51.60 | 0.02 |

| 7.08% Andhra Pradesh SDL (26-Mar-2037) | SOVEREIGN | 46.70 | 0.02 |

| 7.24% GOI 2055 (18-AUG-2055) | SOVEREIGN | 22.90 | 0.01 |

| 7.38% GOI 2027 (20-JUN-2027) | SOVEREIGN | 20.80 | 0.01 |

| Total Gilts | 20,217.96 | 9.01 | |

| Total Debt Holdings | 66,807.09 | 29.76 | |

| Total Holdings | 2,19,200.61 | 97.63 | |

| Call,cash and other current asset | 5,310.71 | 2.37 | |

| Total Asset | 2,24,511.31 | 100.00 | |

| * Top 10 holdings | |||

@ Reverse Repo : 0.71%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 1.66%

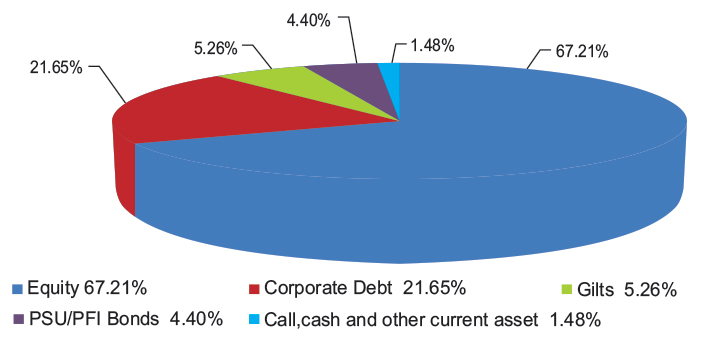

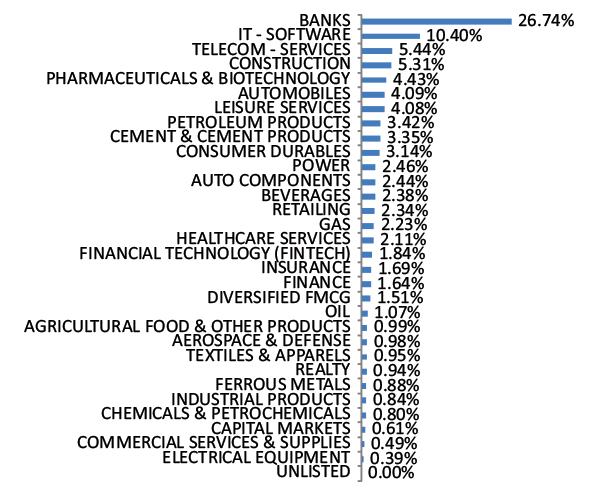

Note : Sector Allocation is provided as a percentage of Equity holding totaling to 100%

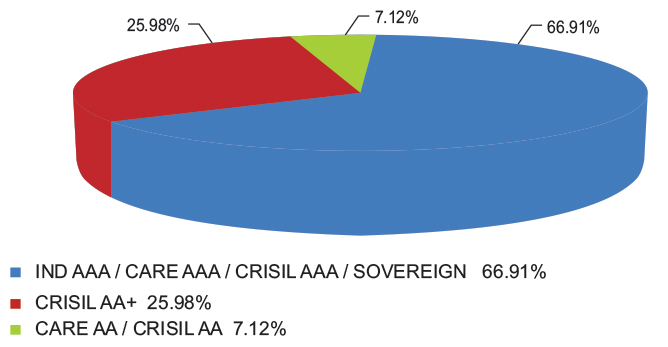

Composition by Rating is provided as a percentage of Debt Holding totaling to 100%

Note : Sector Allocation is provided as a percentage of Equity holding totaling to 100%

Composition by Rating is provided as a percentage of Debt Holding totaling to 100%

$$ - Franklin India Equity Hybrid Fund has been renamed as Franklin India Aggressive Hybrid Fund effective July 11, 2025

This scheme has exposure to floating rate instruments. The duration of these instruments is linked to the interest rate reset period. The interest rate risk in a floating rate instrument or in a fixed rate instrument hedged with derivatives is likely to be lesser than that in an equivalent maturity fixed rate instrument. Under some market circumstances the volatility may be of an order greater than what may ordinarily be expected considering only its duration. Hence investors are recommended to consider the unadjusted portfolio maturity of the scheme as well and exercise adequate due diligence when deciding to make their investments.