Franklin India Equity Savings Fund

As on June 30, 2025

|

Franklin India Equity Savings Fund

As on June 30, 2025 |

|

|

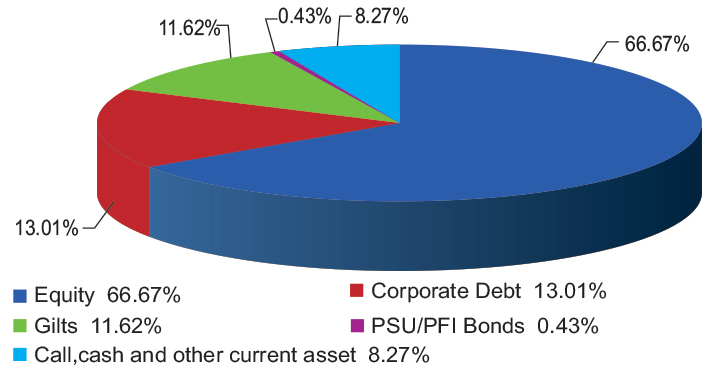

TYPE OF SCHEME

An open-ended scheme investing in equity,arbitrage and fixed income

SCHEME CATEGORY

Equity Savings Fund

SCHEME CHARACTERISTICS

65-90% Equity, 10-35% Debt

INVESTMENT OBJECTIVE

The Scheme intends to generate long-term capital appreciation by investing a portion of the Scheme’s assets in equity and equity related instruments. The Scheme also intends to generate income through investments in fixed income securities and using arbitrage and other derivative Strategies. There can be no assurance that the investment objective of the scheme will be realized.

DATE OF ALLOTMENT:

August 27, 2018

FUND MANAGER(S):

Rajasa Kakulavarapu (Equity)

Venkatesh Sanjeevi (w.e.f. October 4, 2024)

Anuj Tagra (w.e.f. April 30, 2024) (Fixed Income)

Rohan Maru (w.e.f. October 10, 2024)

Sandeep Manam

(dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty Equity Savings Index

EXPENSE RATIO#: 1.12%

EXPENSE RATIO# (DIRECT) : 0.30%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Plan A Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1

ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Plan A Rs1000/1 LOAD STRUCTURE:

* This no load redemption limit is applicable on a yearly basis (from

the date of allotment of such units) and the limit not availed during

a year shall not be clubbed or carried forward to the next year

Different plans have a different expense structure

An open-ended scheme investing in equity,arbitrage and fixed income

SCHEME CATEGORY

Equity Savings Fund

SCHEME CHARACTERISTICS

65-90% Equity, 10-35% Debt

INVESTMENT OBJECTIVE

The Scheme intends to generate long-term capital appreciation by investing a portion of the Scheme’s assets in equity and equity related instruments. The Scheme also intends to generate income through investments in fixed income securities and using arbitrage and other derivative Strategies. There can be no assurance that the investment objective of the scheme will be realized.

DATE OF ALLOTMENT:

August 27, 2018

FUND MANAGER(S):

Rajasa Kakulavarapu (Equity)

Venkatesh Sanjeevi (w.e.f. October 4, 2024)

Anuj Tagra (w.e.f. April 30, 2024) (Fixed Income)

Rohan Maru (w.e.f. October 10, 2024)

Sandeep Manam

(dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty Equity Savings Index

| TURNOVER | |

| Total Portfolio Turnover$ | 705.20% |

| Portfolio Turnover (Equity)** | 908.95% |

| $ Includes fixed income securities and equity derivatives ** Computed for equity portion of the portfolio including equity derivatives | |

| MATURITY & YIELD$ | |

| RESIDUAL MATURITY / AVERAGE MATURITY | 3.40 years |

| ANNUALISED PORTFOLIO YTM# | 6.86% |

| MODIFIED DURATION | 2.74 years |

| MACAULAY DURATION | 2.91 years |

| #Yields of all securities are in annualised terms $ Calculated based on debt holdings in the portfolio | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Plan A Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1

ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Plan A Rs1000/1 LOAD STRUCTURE:

| Plan A Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | Nil (effective October 11, 2021) |

Different plans have a different expense structure

NAV AS OF JUNE 30, 2025

| Growth Plan | Rs 16.3741 |

| IDCW Plan | Rs 14.1666 |

| Monthly IDCW Plan | Rs 13.4033 |

| Quarterly IDCW Plan | Rs 12.4647 |

| Direct - Growth Plan | Rs 17.8889 |

| Direct - IDCW Plan | Rs 15.5475 |

| Direct - Monthly IDCW Plan | Rs 13.9877 |

| Direct - Quarterly IDCW Plan | Rs 13.9826 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs667.32 crores |

| Monthly Average | Rs680.35 crores |

| Outstanding exposure in derivative instruments | Rs 336.43 crores |

| Outstanding derivative exposure | 50.42% |

| Company Name | No. of shares | Market Value Rs Lakhs |

% of Assets | Outstanding derivative exposure as % to net assets Long / (Short ) |

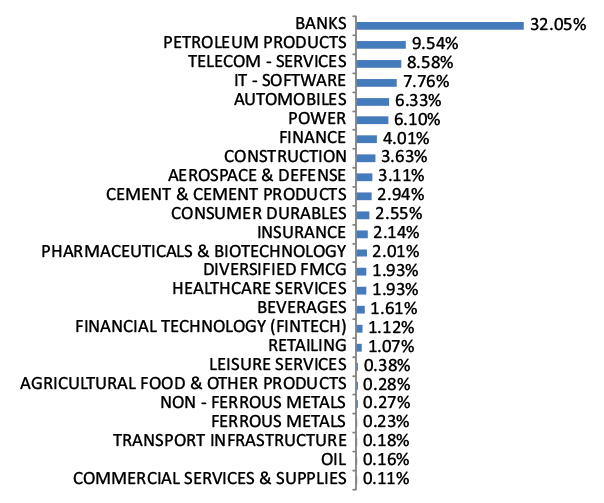

| Aerospace & Defense | ||||

| Hindustan Aeronautics Ltd | 42,000 | 2,045.32 | 3.06 | -3.08 |

| Bharat Electronics Ltd | 26,000 | 109.59 | 0.16 | |

| Agricultural Food & Other Products | ||||

| Marico Ltd | 18,000 | 130.02 | 0.19 | |

| Automobiles | ||||

| Mahindra & Mahindra Ltd | 37,200 | 1,184.15 | 1.77 | -1.77 |

| Tata Motors Ltd | 87,300 | 600.62 | 0.90 | -0.54 |

| Maruti Suzuki India Ltd | 3,000 | 372.00 | 0.56 | |

| Banks | ||||

| Axis Bank Ltd* | 2,78,750 | 3,342.77 | 5.01 | -4.68 |

| HDFC Bank Ltd* | 1,51,200 | 3,026.27 | 4.53 | -2.15 |

| ICICI Bank Ltd* | 1,60,100 | 2,314.73 | 3.47 | -2.25 |

| Kotak Mahindra Bank Ltd | 1,00,000 | 2,163.50 | 3.24 | -3.26 |

| Bank of Baroda | 2,63,250 | 654.91 | 0.98 | -0.99 |

| State Bank of India | 42,700 | 350.29 | 0.52 | |

| Bandhan Bank Ltd | 1,40,400 | 266.25 | 0.40 | -0.40 |

| Canara Bank | 2,22,750 | 254.38 | 0.38 | -0.38 |

| Beverages | ||||

| Varun Beverages Ltd | 76,875 | 351.74 | 0.53 | -0.53 |

| United Spirits Ltd | 19,500 | 278.48 | 0.42 | |

| Cement & Cement Products | ||||

| Ultratech Cement Ltd | 6,500 | 786.05 | 1.18 | -0.91 |

| Ambuja Cements Ltd | 76,650 | 442.62 | 0.66 | -0.67 |

| ACC Ltd | 4,500 | 86.27 | 0.13 | -0.13 |

| Commercial Services & Supplies | ||||

| Teamlease Services Ltd | 2,499 | 50.76 | 0.08 | |

| Construction | ||||

| Larsen & Toubro Ltd | 29,150 | 1,069.75 | 1.60 | -0.48 |

| Consumable Fuels | ||||

| Coal India Ltd | 4,050 | 15.87 | 0.02 | -0.02 |

| Consumer Durables | ||||

| Titan Co Ltd | 21,175 | 781.40 | 1.17 | -1.17 |

| Crompton Greaves Consumer Electricals Ltd | 88,000 | 312.53 | 0.47 | |

| Diversified Fmcg | ||||

| Hindustan Unilever Ltd | 36,300 | 832.94 | 1.25 | -0.84 |

| Ferrous Metals | ||||

| Tata Steel Ltd | 55,000 | 87.87 | 0.13 | -0.13 |

| JSW Steel Ltd | 1,350 | 13.78 | 0.02 | -0.02 |

| Finance | ||||

| Jio Financial Services Ltd | 1,66,850 | 545.18 | 0.82 | -0.82 |

| Power Finance Corporation Ltd | 1,23,500 | 527.84 | 0.79 | -0.79 |

| Cholamandalam Investment and Finance Co Ltd | 23,000 | 374.44 | 0.56 | |

| Bajaj Finserv Ltd | 12,500 | 257.00 | 0.39 | -0.39 |

| REC Ltd | 51,000 | 205.22 | 0.31 | -0.31 |

| Financial Technology (Fintech) | ||||

| PB Fintech Ltd | 20,000 | 364.78 | 0.55 | |

| Healthcare Services | ||||

| Apollo Hospitals Enterprise Ltd | 13,750 | 995.78 | 1.49 | -0.90 |

| Insurance | ||||

| HDFC Life Insurance Co Ltd | 1,32,300 | 1,077.32 | 1.61 | -1.00 |

| ICICI Lombard General Insurance Co Ltd | 6,000 | 122.41 | 0.18 | |

| IT - Software | ||||

| Infosys Ltd | 1,37,200 | 2,197.67 | 3.29 | -1.91 |

| Tech Mahindra Ltd | 51,600 | 870.49 | 1.30 | -1.31 |

| HCL Technologies Ltd | 25,000 | 432.15 | 0.65 | |

| Tata Consultancy Services Ltd | 10,150 | 351.39 | 0.53 | -0.53 |

| Coforge Ltd | 3,375 | 64.95 | 0.10 | -0.10 |

| Leisure Services | ||||

| Jubilant Foodworks Ltd | 14,500 | 101.76 | 0.15 | |

| Non - Ferrous Metals | ||||

| Hindalco Industries Ltd | 16,800 | 116.40 | 0.17 | -0.18 |

| Petroleum Products | ||||

| Reliance Industries Ltd* | 1,95,000 | 2,926.17 | 4.38 | -3.87 |

| Hindustan Petroleum Corporation Ltd | 3,19,950 | 1,401.54 | 2.10 | -2.11 |

| Bharat Petroleum Corporation Ltd | 1,63,925 | 544.15 | 0.82 | -0.82 |

| Indian Oil Corporation Ltd | 1,65,750 | 243.59 | 0.37 | -0.37 |

| Pharmaceuticals & Biotechnology | ||||

| Cipla Ltd | 29,250 | 440.48 | 0.66 | -0.66 |

| Sun Pharmaceutical Industries Ltd | 14,000 | 234.60 | 0.35 | -0.35 |

| Biocon Ltd | 15,000 | 53.36 | 0.08 | -0.08 |

| Power | ||||

| NTPC Ltd* | 7,55,000 | 2,528.50 | 3.79 | -2.63 |

| Tata Power Co Ltd | 2,26,200 | 917.13 | 1.37 | -1.38 |

| Power Grid Corporation of India Ltd | 1,34,900 | 404.57 | 0.61 | -0.61 |

| Realty | ||||

| Godrej Properties Ltd | 17,050 | 399.50 | 0.60 | -0.60 |

| Retailing | ||||

| Eternal Ltd | 2,25,000 | 594.34 | 0.89 | |

| Telecom - Services | ||||

| Bharti Airtel Ltd | 1,07,425 | 2,158.81 | 3.24 | -2.27 |

| Indus Towers Ltd | 2,17,302 | 915.06 | 1.37 | -0.95 |

| Vodafone Idea Ltd | 96,49,125 | 716.93 | 1.07 | -1.08 |

| Total Equity Holdings | 45,008.35 | 67.45 | -50.42 | |

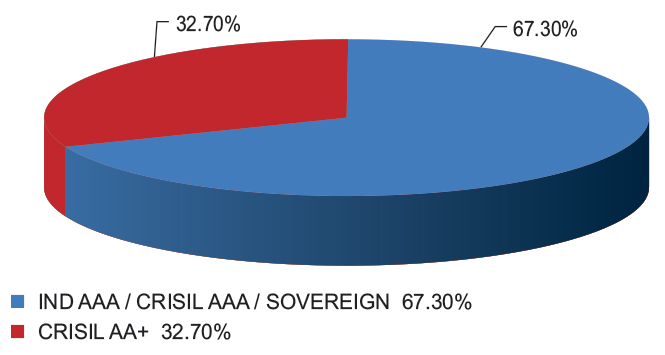

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of Assets | |

| Bajaj Finance Ltd* | IND AAA | 3,144.52 | 4.71 | |

| Bharti Telecom Ltd* | CRISIL AA+ | 2,693.79 | 4.04 | |

| Embassy Office Parks Reit* | CRISIL AAA | 2,511.71 | 3.76 | |

| Jubilant Bevco Ltd* | CRISIL AA | 2,387.08 | 3.58 | |

| Jubilant Beverages Ltd | CRISIL AA | 1,039.72 | 1.56 | |

| Poonawalla Fincorp Ltd | CRISIL AAA | 1,017.35 | 1.52 | |

| Total Corporate Debt | 12,794.18 | 19.17 | ||

| REC Ltd | CRISIL AAA | 278.16 | 0.42 | |

| Total PSU/PFI Bonds | 278.16 | 0.42 | ||

| 7.37% GOI 2028 (23-OCT-2028)* | SOVEREIGN | 2,641.81 | 3.96 | |

| 7.06% GOI 2028 (10-APR-2028) | SOVEREIGN | 1,045.51 | 1.57 | |

| 7.10% Rajasthan SDL (26-Mar-2043) | SOVEREIGN | 42.46 | 0.06 | |

| Total Gilts | 3,729.78 | 5.59 | ||

| Total Debt Holdings | 16,802.12 | 25.18 | ||

| Total Holdings | 61,810.47 | 92.62 | ||

| Margin on Derivatives | 1,669.89 | 2.50 | ||

| Call,cash and other current asset | 3,252.01 | 4.87 | ||

| Total Asset | 66,732.36 | 100.00 | ||

| * Top 10 holdings | ||||

@ Reverse Repo : 4.84%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 0.03%