As on May 30, 2025

|

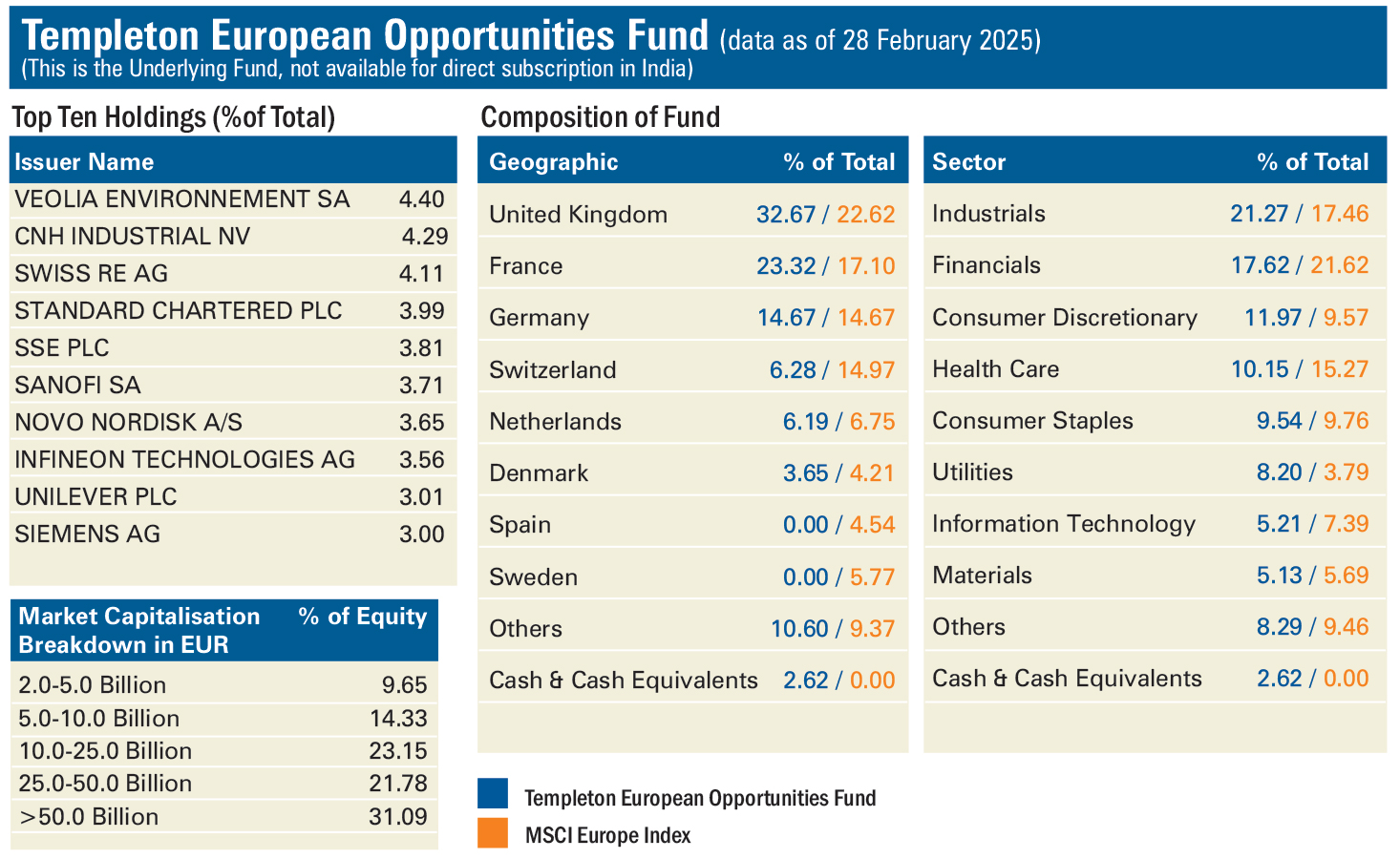

Franklin India Feeder - Templeton European Opportunities Fund As on May 30, 2025 |

|

|

An open ended fund of fund scheme investing in units of Templeton European Opportunities Fund

SCHEME CATEGORY

FOF - Overseas - Europe

SCHEME CHARACTERISTICS

Minimum 95% assets in the underlying funds

INVESTMENT OBJECTIVE

The Fund seeks to provide capital appreciation by investing predominantly in units of Templeton European Opportunities Fund, an overseas equity fund which primarily invests in securities of issuers incorporated or having their principal business in European countries. However, there is no assurance or guarantee that the objective of the scheme will be achieved.

DATE OF ALLOTMENT

May 16, 2014

FUND MANAGER(S)

(FOR FRANKLIN INDIA FEEDER - TEMPLETON EUROPEAN OPPORTUNITIES FUND)Sandeep Manam

FUND MANAGER(S)

(FOR TEMPLETON EUROPEAN OPPORTUNITIES FUND)Craig Cameron

Tian Qiu

James Webb

BENCHMARK

MSCI Europe Index

PLANS

Growth and Dividend (with Reinvestment & Payout Options) Direct – Growth and Dividend (with Reinvestment & Payout Options)

MINIMUM APPLICATION AMOUNT

₹ 5,000 and in multiples of Re.1 thereafter

EXPENSE RATIO#: 1.33% EXPENSE RATIO# (DIRECT) : 0.47%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | 1% if the Units are redeemed/ switched out within one year from the date of allotment (effective January 15, 2020) |

‘Investors may note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes in which this Scheme makes investment’

| Growth Plan | Rs 11.3028 |

| IDCW Plan | Rs 11.3028 |

| Direct - Growth Plan | Rs 12.7228 |

| Direct - IDCW Plan | Rs 12.7228 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs18.41 Crores |

| Monthly Average | Rs18.33 Crores |

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Mutual Fund Units | |||

| Templeton European Opportunities Fund, Class I (Acc) | 57,116 | 1,818.41 | 98.76 |

| Total Mutual Fund Units | 1,818.41 | 98.76 | |

| Total Holdings | 1,818.41 | 98.76 | |

| Call,cash and other current asset | 22.89 | 1.24 | |

| Total Asset | 1,841.30 | 100.00 | |

@ Reverse Repo : 2.00%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : -0.76%

Disclaimer :

This document does not constitute legal or tax advice nor investment advice or an offer for shares of the Fund. Subscriptions to shares of the Fund can only be

made on the basis of the current prospectus and where available, the relevant Key Investor Information Document, accompanied by the latest available audited

annual report and semi-annual report accessible on our website at www.franklintempleton.lu or which can be obtained, free of charge, from Franklin Templeton

International Services, S.à r.l. - Supervised by the Commission de Surveillance du Secteur Financier - 8A, rue Albert Borschette, L-1246 Luxembourg. The value of

shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. No shares of the Fund may be

directly or indirectly offered or sold to residents of the United States of America. Shares of the Fund are not available for distribution in all jurisdictions and

prospective investors should confirm availability with their local Franklin Templeton Investments representative before making any plans to invest. An

investment in the Fund entails risks, which are described in the Fund’s prospectus and where available, in the relevant Key Investor Information Document.

Special risks may be associated with a Fund’s investment in certain types of securities, asset classes, sectors, markets, currencies or countries and in the

Fund’s possible use of derivatives. These risks are more fully described in the Fund’s prospectus and where available, in the relevant Key Investor Information

Document and should be read closely before investing. Information is historical and may not reflect current or future portfolio characteristics. All portfolio

holdings are subject to change. References to particular industries, sectors or companies are for general information and are not necessarily indicative of a fund's

holding at any one time. All MSCI data is provided “as is.” The Fund described herein is not sponsored or endorsed by MSCI. In no event shall MSCI, its affiliates or

any MSCI data provider have any liability of any kind in connection with the MSCI data or the Fund described herein. Copying or redistributing the MSCI data is

strictly prohibited. Top Ten Holdings: These securities do not represent all of the securities purchased, sold or recommended for clients, and the reader should not

assume that investment in the securities listed was or will be profitable. The portfolio manager for the Fund reserves the right to withhold release of information

with respect to holdings that would otherwise be included in the top holdings list.

The expenses of the Fund of Funds scheme will be over and above the expenses charged by the underlying scheme. Investments in overseas financial assets are

subject to risks associated with currency movements, restrictions on repatriation, transaction procedures in overseas markets and country related risks.

Investors cannot directly invest in the Underlying fund, as the Underlying fund is not available for

distribution.

The name of the Scheme stands changed from Franklin India Feeder – Franklin European Growth Fund to Franklin India Feeder –

Templeton European Opportunities Fund with effect from August 18, 2020. Please read the addendum for further details.

#Franklin India Feeder - Templeton European Opportunities Fund (FIF-TEOF) shall be merged with Franklin U.S. Opportunities

Equity Active Fund of Funds (FUSOF) w.e.f June 30, 2025.

Please click here for Product Label & Benchmark Risk-o-meter.