Franklin India Focused Equity Fund

As on September 30, 2025

|

Franklin India Focused Equity Fund As on September 30, 2025 |

|

|

TYPE OF SCHEME

An open ended equity scheme investing in maximum 30 stocks. The scheme intends to focus on Multi-cap space

SCHEME CATEGORY

Focused Fund

SCHEME CHARACTERISTICS

Max 30 Stocks, Min 65% Equity, Focus on Multi-Cap

INVESTMENT OBJECTIVE

An open-end focused equity fund that seeks to achieve capital appreciation through investing predominantly in Indian companies/sectors with high growth rates or potential.

DATE OF ALLOTMENT:

July 26, 2007

FUND MANAGER(S):

Ajay Argal, Venkatesh Sanjeevi (w.e.f. October 4, 2024) Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty 500

EXPENSE RATIO#: 1.76%

EXPENSE RATIO# (DIRECT) : 0.95%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

Different plans have a different expense structure

An open ended equity scheme investing in maximum 30 stocks. The scheme intends to focus on Multi-cap space

SCHEME CATEGORY

Focused Fund

SCHEME CHARACTERISTICS

Max 30 Stocks, Min 65% Equity, Focus on Multi-Cap

INVESTMENT OBJECTIVE

An open-end focused equity fund that seeks to achieve capital appreciation through investing predominantly in Indian companies/sectors with high growth rates or potential.

DATE OF ALLOTMENT:

July 26, 2007

FUND MANAGER(S):

Ajay Argal, Venkatesh Sanjeevi (w.e.f. October 4, 2024) Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty 500

| TURNOVER: | |

| Portfolio Turnover | 18.99% |

| VOLATILITY MEASURES (3 YEARS): | |

| Standard Deviation | 3.44% |

| Beta | 0.89 |

| Sharpe Ratio* | 0.84 |

| * Annualised. Risk-free rate assumed to be 5.74% (FBIL OVERNIGHT MIBOR) | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | 1% if redeemed/switchedout within one year of allotment. |

Different plans have a different expense structure

NAV AS OF SEPTEMBER 30, 2025

| Growth Plan | Rs107.1180 |

| IDCW Plan | Rs 35.5788 |

| Direct - Growth Plan | Rs 120.8548 |

| Direct - IDCW Plan | Rs42.1336 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs12302.98 crores |

| Monthly Average | Rs 12480.49 crores |

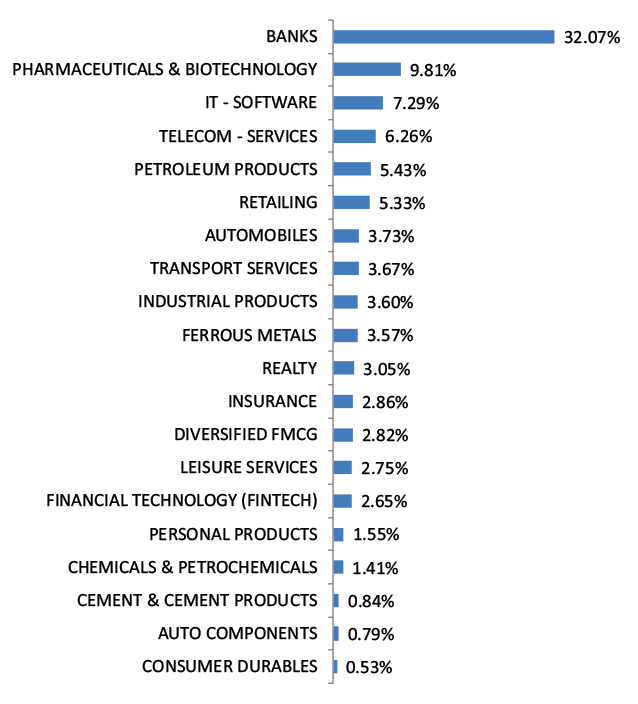

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Agricultural, Commercial & Construction Vehicles | |||

| Ashok Leyland Ltd | 1,43,00,000 | 20,401.81 | 1.66 |

| Automobiles | |||

| Maruti Suzuki India Ltd* | 3,08,000 | 49,369.32 | 4.01 |

| Banks | |||

| HDFC Bank Ltd* | 1,22,00,000 | 1,16,022.00 | 9.43 |

| ICICI Bank Ltd* | 83,00,000 | 1,11,884.00 | 9.09 |

| Axis Bank Ltd* | 65,00,000 | 73,554.00 | 5.98 |

| State Bank of India | 42,00,000 | 36,642.90 | 2.98 |

| IndusInd Bank Ltd | 21,00,000 | 15,446.55 | 1.26 |

| Chemicals & Petrochemicals | |||

| Deepak Nitrite Ltd | 7,67,769 | 14,089.33 | 1.15 |

| Consumer Durables | |||

| Somany Ceramics Ltd | 13,68,783 | 6,111.62 | 0.50 |

| Diversified Fmcg | |||

| Hindustan Unilever Ltd | 14,25,000 | 35,830.20 | 2.91 |

| Ferrous Metals | |||

| Tata Steel Ltd | 2,50,00,000 | 42,192.50 | 3.43 |

| Financial Technology (Fintech) | |||

| PB Fintech Ltd | 18,77,308 | 31,951.78 | 2.60 |

| Industrial Products | |||

| KEI Industries Ltd | 7,13,829 | 28,997.88 | 2.36 |

| Cummins India Ltd | 5,40,000 | 21,203.10 | 1.72 |

| Insurance | |||

| HDFC Life Insurance Co Ltd | 47,00,000 | 35,553.15 | 2.89 |

| IT - Software | |||

| Tata Consultancy Services Ltd* | 26,00,000 | 75,098.40 | 6.10 |

| Leisure Services | |||

| Jubilant Foodworks Ltd | 44,68,295 | 27,587.25 | 2.24 |

| Personal Products | |||

| Dabur India Ltd | 33,00,000 | 16,212.90 | 1.32 |

| Petroleum Products | |||

| Reliance Industries Ltd* | 48,00,000 | 65,472.00 | 5.32 |

| Pharmaceuticals & Biotechnology | |||

| Cipla Ltd* | 35,00,000 | 52,615.50 | 4.28 |

| Sun Pharmaceutical Industries Ltd* | 32,00,000 | 51,017.60 | 4.15 |

| Realty | |||

| Sobha Ltd | 26,93,087 | 41,513.94 | 3.37 |

| Retailing | |||

| Eternal Ltd* | 2,35,00,000 | 76,492.50 | 6.22 |

| Trent Ltd | 2,25,000 | 10,524.38 | 0.86 |

| Telecom - Services | |||

| Bharti Airtel Ltd* | 39,00,000 | 73,257.60 | 5.95 |

| Transport Services | |||

| Interglobe Aviation Ltd | 6,00,000 | 33,567.00 | 2.73 |

| Delhivery Ltd | 45,00,000 | 20,252.25 | 1.65 |

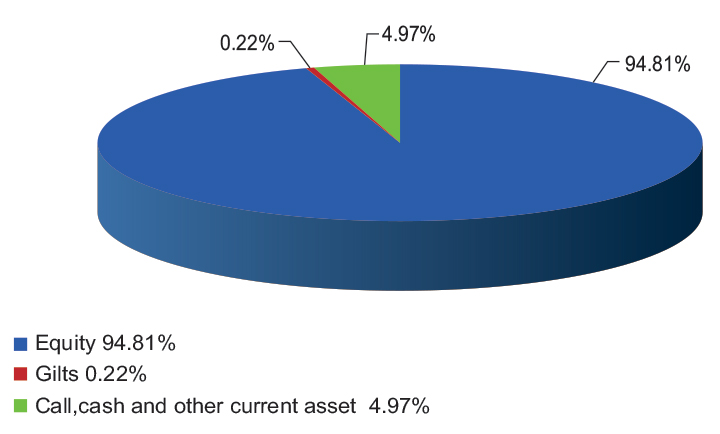

| Total Equity Holdings | 11,82,861.45 | 96.14 | |

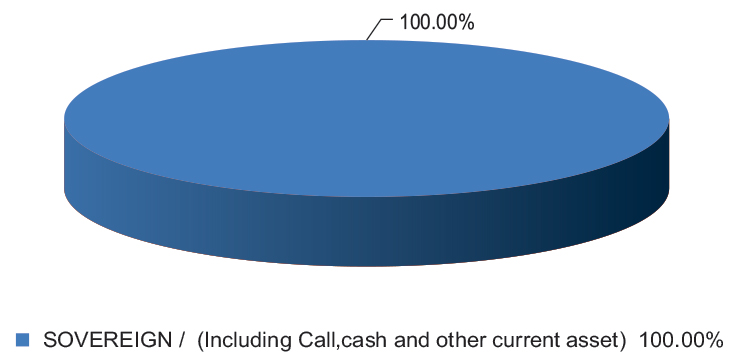

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of Assets |

| 91 DTB (13-NOV-2025) | SOVEREIGN | 2,484.20 | 0.20 |

| Total Gilts | 2,484.20 | 0.20 | |

| Total Debt Holdings | 2,484.20 | 0.20 | |

| Total Holdings | 11,85,345.64 | 96.35 | |

| Call,cash and other current asset | 44,952.66 | 3.65 | |

| Total Asset | 12,30,298.31 | 100.00 | |

| * Top 10 holdings | |||

@ Reverse Repo : 4.06%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : -0.41%

Please click here for Product Label & Benchmark Risk-o-meter.