|

Franklin India Government Securities Fund

As on June 30, 2025 |

|

|

An open ended debt scheme investing in government securities across maturity

SCHEME CATEGORY

Gilt Fund

SCHEME CHARACTERISTICS

Min 80% in G-secs (across maturity)

INVESTMENT OBJECTIVE

The Primary objective of the Scheme is to generate return through investments in sovereign securities issued by the Central Government and / or a State Government and / or any security unconditionally guaranteed by the central Government and / or State Government for repayment of Principal and Interest

DATE OF ALLOTMENT:

| December 7, 2001 |

FUND MANAGER(S):

Anuj Tagra (w.e.f. March 07, 2024)

Rahul Goswami (w.e.f. October 6, 2023)

BENCHMARK:

NIFTY All Duration G-Sec Index

| MATURITY & YIELD | |

| RESIDUAL MATURITY/AVERAGE MATURITY | 19.36 years |

| ANNUALISED PORTFOLIO YTM# | 6.42% |

| MODIFIED DURATION | 5.21 years |

| MACAULAY DURATION | 5.40 years |

***Yield to maturity (YTM) of the portfolio is calculated by recomputing yield from simple average of valuation prices provided by valuation agencies for G-sec FRB securities.

EXPENSE RATIO#: 1.14%

EXPENSE RATIO# (DIRECT) : 0.62%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT FOR NEW /

EXISTING INVESTORS:

| Rs10,000/1 (G); |

| Rs25,000/1 (D); |

Rs 500/1

ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

| Rs1000/1; |

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | Nil *CDSC is treated similarly |

Different plans have a different expense structure

Benchmark for FIGSF has been changed to NIFTY All Duration G-Sec Index, effective from 8th September 2021

| FIGSF | |

| Growth Plan | Rs 58.5167 |

| IDCW Plan | Rs 10.7145 |

| FIGSF (Direct) | |

| Growth Plan | Rs 64.1157 |

| IDCW Plan | Rs 11.9746 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs 155.21 crores |

| Monthly Average | Rs 154.95 crores |

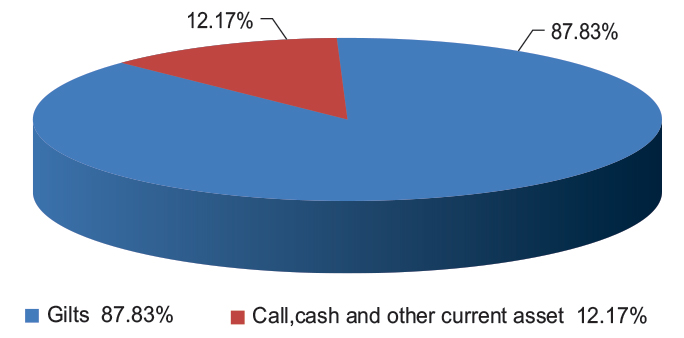

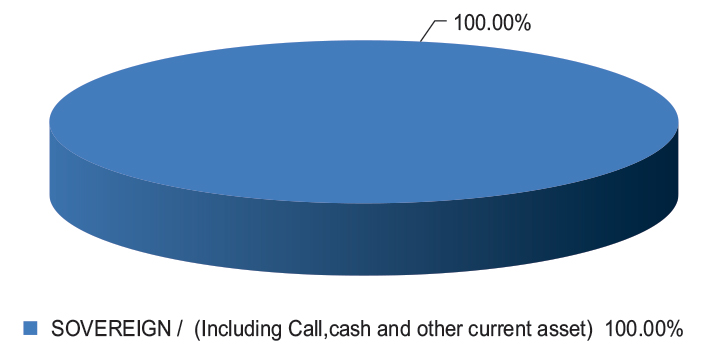

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of assets |

| 6.90% GOI 2065 (15-APR-2065) | SOVEREIGN | 7,009.43 | 45.16 |

| 91 DTB (24-JUL-2025) | SOVEREIGN | 2,491.67 | 16.05 |

| 6.84% Andhra Pradesh SDL (04-Jun-2038) | SOVEREIGN | 1,482.63 | 9.55 |

| 7.32% Chhattisgarh SDL (05-Mar-2037) | SOVEREIGN | 55.50 | 0.36 |

| 7.32% West Bengal SDL (05-Mar-2038) | SOVEREIGN | 52.33 | 0.34 |

| 7.10% Rajasthan SDL (26-Mar-2043) | SOVEREIGN | 42.46 | 0.27 |

| Total Gilts | 11,134.02 | 71.73 | |

| Total Debt Holdings | 11,134.02 | 71.73 | |

| Total Holdings | 11,134.02 | 71.73 | |

| Margin on Derivatives | 5.23 | 0.03 | |

| Call,cash and other current asset | 4,382.00 | 28.23 | |

| Total Asset | 15,521.24 | 100.00 | |

Outstanding Interest Rate Swap Position

| Contract Name | Notional Value (In Lakhs) | % of assets |

| IDFC First Bank (Pay Fixed - Receive Floating) | 1,000 | 6.44% |

| IDFC First Bank (Pay Fixed - Receive Floating) | 1,000 | 6.44% |

| ICICI Bank (Pay Fixed - Receive Floating) | 1,500 | 6.44% |

| IDFC First Bank (Pay Fixed - Receive Floating) | 1,500 | 9.66% |

| IDFC First Bank (Pay Fixed - Receive Floating) | 1,500 | 9.66% |

| Total Interest Rate Swap | 6,000 | 38.66% |

@ TREPs / Reverse Repo : 27.26%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 0.97%

All investments in debt funds are subject to various types of risks including credit risk, interest rate risk, liquidity risk etc. Some fixed income schemes may have a higher

concentration to securities rated below AA and therefore may be exposed to relatively higher risk of downgrade or default and the associated volatility in prices which

could impact NAV of the scheme. Credit rating issued by SEBI registered entities is an opinion of the rating agency and should not be considered as an assurance of

repayment by issuer. There is no assurance or guarantee of principal or returns in any of the mutual fund scheme.

This scheme has exposure to floating rate instruments . The duration of these instruments is linked to the interest rate reset period. The interest rate risk in a floating rate

instrument or in a fixed rate instrument hedged with derivatives is likely to be lesser than that in an equivalent maturity fixed rate instrument. Under some market

circumstances the volatility may be of an order greater than what may ordinarily be expected considering only its duration. Hence investors are recommended to

consider the unadjusted portfolio maturity of the scheme as well and exercise adequate due diligence when deciding to make their investments.

Franklin India Government Securities Fund (FIGSF) - Composite and PF Plan (Merging Plans) to be merged into FIGSF – Long Term Plan (Surviving Plan) effective June 4, 2018.