Franklin India Long Duration Fund

As on June 30, 2025

|

Franklin India Long Duration Fund As on June 30, 2025 |

|

|

TYPE OF SCHEME

An open ended debt scheme investing in instruments such that the Macaulay Duration of the portfolio is greater than 7 years.

SCHEME CATEGORY

Long Duration Fund

SCHEME CHARACTERISTICS

Debt Securities (including central and state Government Securities) Upto 100%. Securitised Debt upto 30%.

INVESTMENT OBJECTIVE

The investment objective of the scheme is to generate returns by investing in debt and money market instruments such that the Macaulay duration of the scheme portfolio is greater than 7 years.

DATE OF ALLOTMENT:

FUND MANAGER(S):

Anuj Tagra & Chandni Gupta

BENCHMARK:

CRISIL Long Duration Debt A-III Index

MATURITY & YIELD

#Yields of all securities are in annualised terms

EXPENSE RATIO#: 0.86% EXPENSE RATIO# (DIRECT) : 0.33%

MINIMUM INVESTMENT FOR NEW /

EXISTING INVESTORS

Rs5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1

ADDITIONAL INVESTMENT/MULTIPLES

FOR EXISTING INVESTORS

Rs1000/1 LOAD STRUCTURE:

Please click here for Product Label & Benchmark Risk-o-meter.

An open ended debt scheme investing in instruments such that the Macaulay Duration of the portfolio is greater than 7 years.

SCHEME CATEGORY

Long Duration Fund

SCHEME CHARACTERISTICS

Debt Securities (including central and state Government Securities) Upto 100%. Securitised Debt upto 30%.

INVESTMENT OBJECTIVE

The investment objective of the scheme is to generate returns by investing in debt and money market instruments such that the Macaulay duration of the scheme portfolio is greater than 7 years.

DATE OF ALLOTMENT:

| December 13, 2024 |

Anuj Tagra & Chandni Gupta

BENCHMARK:

CRISIL Long Duration Debt A-III Index

| RESIDUAL MATURITY / AVERAGE MATURITY | 23.12 Years |

| ANNUALISED PORTFOLIO YTM# | 6.49% |

| MODIFIED DURATION | 7.59 Years |

| MACAULAY DURATION | 7.86 Years |

EXPENSE RATIO#: 0.86% EXPENSE RATIO# (DIRECT) : 0.33%

| # The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. |

EXISTING INVESTORS

Rs5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1

ADDITIONAL INVESTMENT/MULTIPLES

FOR EXISTING INVESTORS

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | Nil |

| Different plans have a different expense structure |

NAV AS OF JUNE 30, 2025

| Growth Plan | Rs 10.3593 |

| IDCW Plan | Rs10.2593 |

| Direct - Growth Plan | Rs 10.3907 |

| Direct - IDCW Plan | Rs10.2907 |

As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs29.50 Crores |

| Monthly Average | Rs27.18 Crores |

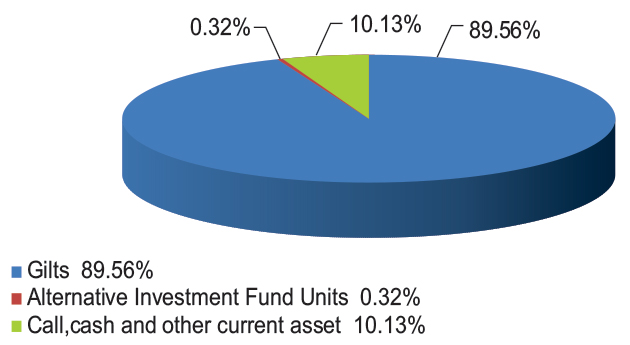

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of assets |

| 6.90% GOI 2065 (15-APR-2065) | SOVEREIGN | 1,708.20 | 57.90 |

| Total Gilts | 1,708.20 | 57.90 | |

| Total Debt Holdings | 1,708.20 | 57.90 | |

| Company Name | No.of Shares | Market Value(Rs. in Lakhs) | % of Assets |

| Alternative Investment Fund Units | |||

| Corporate Debt Market Development Fund Class A2 | 72 | 8.15 | 0.28 |

| Total Alternative Investment Fund Units | 8.15 | 0.28 | |

| Total Holdings | 1,716.35 | 58.18 | |

| Call,cash and other current asset | 1,233.88 | 41.82 | |

| Total Asset | 2,950.23 | 100.00 | |

@ TREPs / Reverse Repo : 36.62%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 5.20%