(Erstwhile Franklin India Savings Fund)$$

|

Franklin India Money Market Fund (Erstwhile Franklin India Savings Fund)$$ As on June 30, 2025 |

|

|

An open ended debt scheme investing in money market instruments

SCHEME CATEGORY

Money Market Fund

SCHEME CHARACTERISTICS

Money Market Instruments with Maturity upto 1 year

INVESTMENT OBJECTIVE

To provide income and liquidity consistent with the prudent risk from a portfolio comprising of money market instruments.

DATE OF ALLOTMENT (MAIN PORTFOLIO):

| Retail Option | Feb 11, 2002 |

| Institutional Option | Sep 6, 2005 |

FUND MANAGER(S):

Rohan Maru (w.e.f. October 10, 2024)

Chandni Gupta (w.e.f. April 30, 2024)

& Rahul Goswami

BENCHMARK:

NIFTY Money Market Index A-I (w.e.f. April 1, 2024)

| MATURITY & YIELD | |

| RESIDUAL MATURITY / AVERAGE MATURITY | 0.63 Years 230 Days |

| ANNUALISED PORTFOLIO YTM# | 6.25% |

| MODIFIED DURATION | 0.59 Years 217 Days |

| MACAULAY DURATION | 0.63 Years 230 Days |

EXPENSE RATIO#: 0.30% (Retail) EXPENSE RATIO# (DIRECT) : 0.14% (Retail)

All investors have redeemed from the Institutional Plan in FIMMF effective June 19, 2020 and this Plan has been closed for subscription / redemption

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Retail Plan: Rs10,000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1

ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Retail Plan:Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | Nil |

| Different plans have a different expense structure | ||

| Retail Plan | |

| Growth Plan | Rs 50.2916 |

| Quarterly IDCW | Rs 11.0680 |

| Monthly IDCW | Rs 10.5516 |

| Daily IDCW | Rs 10.1027 |

| Weekly IDCW | Rs10.0898 |

| Retail Plan (Direct) | |

| Growth Plan | Rs 51.9631 |

| Quarterly IDCW | Rs 11.6008 |

| Monthly IDCW | Rs 10.9663 |

| Daily IDCW | Rs 10.1135 |

| Weekly IDCW | Rs 10.1002 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs 3441.02 Crores |

| Monthly Average | Rs 3539.70 Crores |

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of assets | |||

| HDFC Bank Ltd* | CARE A1+ | 33,273.74 | 9.67 | |||

| National Bank For Agriculture & Rural Development* | IND A1+ | 26,455.04 | 7.69 | |||

| Small Industries Development Bank of India* | CARE A1+ | 26,452.72 | 7.69 | |||

| Export-Import Bank Of India* | CRISIL A1+ | 26,402.09 | 7.67 | |||

| Indian Bank* | CRISIL A1+ | 23,006.56 | 6.69 | |||

| Kotak Mahindra Bank Ltd* | CRISIL A1+ | 16,829.19 | 4.89 | |||

| Canara Bank* | CRISIL A1+ | 15,842.42 | 4.60 | |||

| Tata Capital Ltd* | CRISIL A1+ | 11,798.86 | 3.43 | |||

| National Bank For Agriculture & Rural Development* | CRISIL A1+ | 9,640.23 | 2.80 | |||

| Hero Fincorp Ltd | CRISIL A1+ | 9,607.42 | 2.79 | |||

| ICICI Securities Ltd | CRISIL A1+ | 9,589.34 | 2.79 | |||

| Tata Capital Ltd | ICRA A1+ | 9,548.02 | 2.77 | |||

| Muthoot Finance Ltd | ICRA A1+ | 9,543.87 | 2.77 | |||

| Cholamandalam Investment and Finance Co Ltd | CRISIL A1+ | 9,400.11 | 2.73 | |||

| LIC Housing Finance Ltd | ICRA A1+ | 7,243.93 | 2.11 | |||

| IDBI Bank Ltd | CRISIL A1+ | 7,230.18 | 2.10 | |||

| Mankind Pharma Ltd | CRISIL A1+ | 6,871.70 | 2.00 | |||

| Axis Bank Ltd | CRISIL A1+ | 6,255.45 | 1.82 | |||

| Aditya Birla Capital Ltd | IND A1+ | 4,807.87 | 1.40 | |||

| Punjab National Bank | CARE A1+ | 4,788.20 | 1.39 | |||

| Punjab National Bank | CRISIL A1+ | 4,782.74 | 1.39 | |||

| Bahadur Chand Investments Pvt Ltd | CARE A1+ | 4,759.27 | 1.38 | |||

| Standard Chartered Securities (India) Ltd | ICRA A1+ | 2,465.48 | 0.72 | |||

| Bank of Baroda | IND A1+ | 2,395.89 | 0.70 | |||

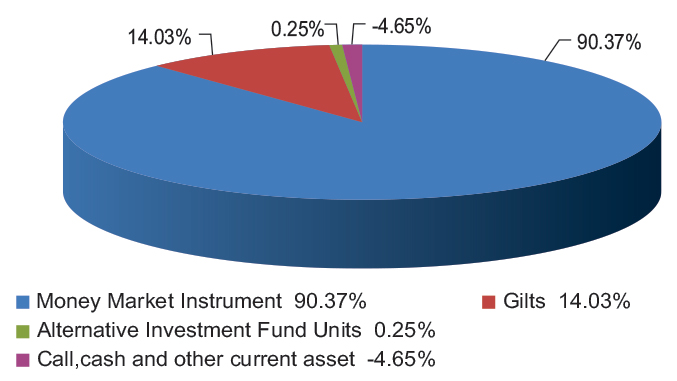

| Total Money Market Instruments | 2,88,990.31 | 83.98 | ||||

| 364 DTB (05-MAR-2026)* | SOVEREIGN | 21,689.26 | 6.30 | |||

| 364 DTB (12-MAR-2026) | SOVEREIGN | 4,815.04 | 1.40 | |||

| 8.39% Rajasthan Uday (15-Mar-2026) | SOVEREIGN | 2,978.62 | 0.87 | |||

| 364 DTB (22-JAN-2026) | SOVEREIGN | 307.00 | 0.09 | |||

| Total Gilts | 29,789.92 | 8.66 | ||||

| Total Debt Holdings | 3,18,780.23 | 92.64 | ||||

| Company Name | No.of Shares | Market Value(Rs. in Lakhs) | % of Assets | |||

| Alternative Investment Fund Units | ||||||

| Corporate Debt Market Development Fund Class A2 | 5,772 | 649.01 | 0.19 | |||

| Total Alternative Investment Fund Units | 649.01 | 0.19 | ||||

| Total Holdings | 3,19,429.24 | 92.83 | ||||

| Call,cash and other current asset | 24,672.26 | 7.17 | ||||

| Total Asset | 3,44,101.51 | 100.00 | ||||

| * Top 10 holdings | ||||||

@ TREPs /Reverse Repo : 6.51%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 0.66%

$$ - Franklin India Savings Fund is renamed as Franklin India Money Market Fund effective May 15, 2023

Aggregate investments by other schemes of Franklin Templeton Mutual Fund in this scheme is Rs. 552.66 Lakhs.

AUM excluding the aggregate investments by other schemes of Franklin Templeton Mutual Fund in this scheme is Rs. 2,54,230.25 Lakhs.

Average AUM excluding the aggregate investments by other schemes of Franklin Templeton Mutual Fund in this scheme is Rs. 2,88,255.92 Lakhs.

“India Ratings and Research (Ind-Ra) has assigned a credit rating of “IND A1+mfs” to “Franklin India Money Market Fund”. Ind-Ra’s National Scale Money Market Fund Rating

primarily focuses on the investment objective of preservation of capital. India Ratings reviews, among other factors, applicable fund regulation, track record of the fund

industry, industry standards and practices. An India Ratings MMF rating is primarily based on an analysis of the fund’s investment policy. India Ratings expects MMFs to be

diversified and to adhere to conservative guidelines limiting credit, market and liquidity risks. India Ratings typically requests monthly portfolio holdings and relevant

performance statistics to actively monitor national scale MMF Ratings. Ratings do not guarantee the return profile or risk attached to the investments made. Ratings are not a

recommendation or suggestion, directly or indirectly, to you or any other person, to buy, sell, make or hold any investment, loan or security or to undertake any investment

strategy with respect to any investment, loan or security or any issuer. Ratings do not comment on the adequacy of market price, the suitability of any investment, loan or

security for a particular investor (including without limitation, any accounting and/or regulatory treatment), or the tax-exempt nature or taxability of payments made in respect

of any investment, loan or security. India Ratings is not your advisor, nor is India Ratings providing to you or any other party any financial advice, or any legal, auditing,

accounting, appraisal, valuation or actuarial services. A rating should not be viewed as a replacement for such advice or services.

CRISIL Ratings’ assessment of a rated fund’s credit quality is based on the creditworthiness of the fund’s portfolio. CRISIL Ratings has developed a credit quality matrix to assess

the aggregate credit quality of a fund’s underlying portfolio. The matrix is a set of credit factors and credit scores derived scientifically from the default and transition rates of

CRISIL Ratings’ long-term ratings. The credit factors reflect the expected default behaviour of the respective securities in the portfolio, and the expected deterioration in their

credit quality. The lower the credit factor for each security, the higher would be its inherent credit quality. The credit factors are applied to the proportion of securities held in

each rating category to arrive at the credit score for the portfolio. The rating on the fund is assigned on the basis of the fund’s total credit score. A rated fund needs to maintain, at

all times, a credit score consistent with its assigned rating. An evaluation of the portfolio investments done for the last six months indicates that Franklin India Money Market

Fund has maintained its credit score consistently. The assigned rating is valid only for 'Franklin India Money Market Fund'. The rating of CRISIL Ratings is not an opinion of the

AMCs willingness or ability to make timely payments to the investor. The rating is also not an opinion on the stability of the NAV of the Fund, which could vary with market

developments.

All investments in debt funds are subject to various types of risks including credit risk, interest rate risk, liquidity risk etc. Some fixed income schemes may have a higher

concentration to securities rated below AA and therefore may be exposed to relatively higher risk of downgrade or default and the associated volatility in prices which could

impact NAV of the scheme. Credit rating issued by SEBI registered entities is an opinion of the rating agency and should not be considered as an assurance of repayment by

issuer. There is no assurance or guarantee of principal or returns in any of the mutual fund scheme.