Franklin India Multi Cap Fund

As on July 31, 2025

|

Franklin India Multi Cap Fund As on July 31, 2025 |

|

|

TYPE OF SCHEME

An open-ended scheme investing across large cap, midcap and small cap stocks

SCHEME CATEGORY

Multi Cap Fund

SCHEME CHARACTERISTICS

Scheme investing across large cap, mid cap and small cap stocks

INVESTMENT OBJECTIVE

The investment objective of the scheme is to generate long term capital appreciation by investing in a portfolio of equity and equity related securities of large cap, midcap and small cap companies.

DATE OF ALLOTMENT:

July 29, 2024

FUND MANAGER(S):

Kiran Sebastian, Akhil Kalluri &

R. Janakiraman

Sandeep Manam

(dedicated for making investments for Foreign Securities)

BENCHMARK:

NIFTY 500 Multicap 50:25:25 TRI

EXPENSE RATIO#: 1.81%

EXPENSE RATIO# (DIRECT) : 0.37%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

Different plans have a different expense

structure

An open-ended scheme investing across large cap, midcap and small cap stocks

SCHEME CATEGORY

Multi Cap Fund

SCHEME CHARACTERISTICS

Scheme investing across large cap, mid cap and small cap stocks

INVESTMENT OBJECTIVE

The investment objective of the scheme is to generate long term capital appreciation by investing in a portfolio of equity and equity related securities of large cap, midcap and small cap companies.

DATE OF ALLOTMENT:

July 29, 2024

FUND MANAGER(S):

Kiran Sebastian, Akhil Kalluri &

R. Janakiraman

Sandeep Manam

(dedicated for making investments for Foreign Securities)

BENCHMARK:

NIFTY 500 Multicap 50:25:25 TRI

| TURNOVER: | |

| Portfolio Turnover | 63.15% |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | In respect of each purchase of Units - 1% if the Units are redeemed/switched-out within one year of allotment. |

NAV AS OF JULY 31, 2025

| Growth Plan | Rs10.1662 |

| IDCW Plan | Rs 10.1662 |

| Direct - Growth Plan | Rs 10.3225 |

| Direct - IDCW Plan | Rs 10.3225 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs5031.81 Crores |

| Monthly Average | Rs5085.95 Crores |

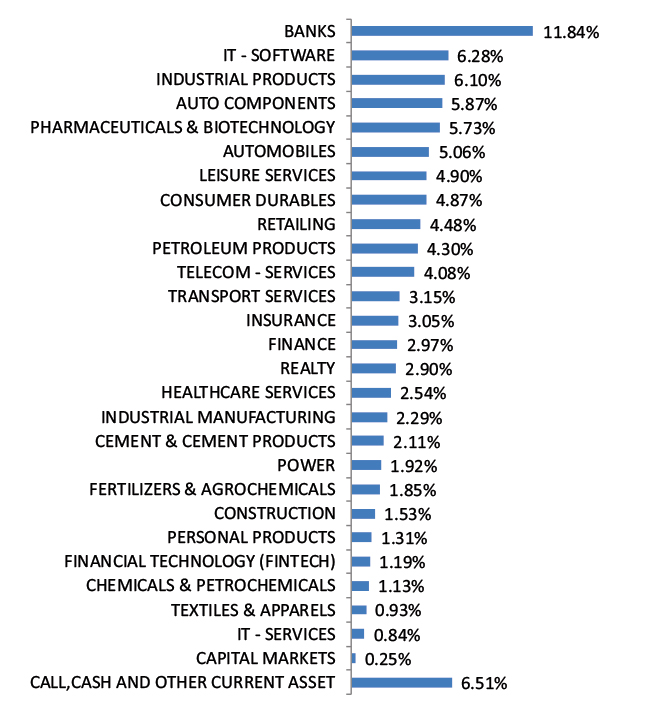

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets | |

| Aerospace & Defense | ||||

| Cyient DLM Ltd | 1,08,978 | 490.62 | 0.10 | |

| Agricultural, Commercial & Construction Vehicles | ||||

| Ashok Leyland Ltd | 62,36,304 | 7,549.05 | 1.50 | |

| Auto Components | ||||

| Tube Investments of India Ltd | 2,98,635 | 8,483.32 | 1.69 | |

| Uno Minda Ltd | 3,49,245 | 3,637.04 | 0.72 | |

| Automobiles | ||||

| Mahindra & Mahindra Ltd* | 4,69,402 | 15,035.42 | 2.99 | |

| Maruti Suzuki India Ltd | 59,691 | 7,525.84 | 1.50 | |

| Eicher Motors Ltd | 98,205 | 5,370.34 | 1.07 | |

| Tata Motors Ltd | 5,21,701 | 3,474.27 | 0.69 | |

| Banks | ||||

| HDFC Bank Ltd* | 15,49,110 | 31,264.14 | 6.21 | |

| Axis Bank Ltd* | 18,67,716 | 19,954.68 | 3.97 | |

| RBL Bank Ltd | 38,15,892 | 10,181.94 | 2.02 | |

| City Union Bank Ltd | 39,72,350 | 8,511.95 | 1.69 | |

| Federal Bank Ltd | 35,79,676 | 7,246.34 | 1.44 | |

| Ujjivan Small Finance Bank Ltd | 1,52,98,810 | 6,772.78 | 1.35 | |

| State Bank of India | 7,71,317 | 6,143.93 | 1.22 | |

| IDFC First Bank Ltd | 71,13,052 | 4,890.93 | 0.97 | |

| Cement & Cement Products | ||||

| Ultratech Cement Ltd | 81,281 | 9,956.11 | 1.98 | |

| Dalmia Bharat Ltd | 91,594 | 2,047.58 | 0.41 | |

| Chemicals & Petrochemicals | ||||

| Sudarshan Chemical Industries Ltd | 5,94,525 | 8,535.60 | 1.70 | |

| Camlin Fine Sciences Ltd | 13,85,638 | 3,705.89 | 0.74 | |

| Consumer Durables | ||||

| Amber Enterprises India Ltd | 68,911 | 5,487.73 | 1.09 | |

| Senco Gold Ltd | 11,13,722 | 3,483.72 | 0.69 | |

| Fertilizers & Agrochemicals | ||||

| UPL Ltd | 12,34,701 | 8,689.83 | 1.73 | |

| UPL Ltd - Partly Paid | 74,920 | 386.44 | 0.08 | |

| Finance | ||||

| HDB Financial Services Ltd | 10,39,608 | 7,885.95 | 1.57 | |

| PNB Housing Finance Ltd | 6,05,153 | 5,968.02 | 1.19 | |

| Financial Technology (Fintech) | ||||

| PB Fintech Ltd | 3,32,201 | 6,019.81 | 1.20 | |

| Healthcare Services | ||||

| Apollo Hospitals Enterprise Ltd | 1,27,368 | 9,550.05 | 1.90 | |

| Aster DM Healthcare Ltd | 14,17,487 | 8,574.38 | 1.70 | |

| Syngene International Ltd | 5,83,923 | 4,169.21 | 0.83 | |

| Industrial Manufacturing | ||||

| Syrma SGS Technology Ltd | 13,75,604 | 10,399.57 | 2.07 | |

| The Anup Engineering Ltd | 74,864 | 1,980.38 | 0.39 | |

| Aditya Infotech Ltd @@ | 1,92,588 | 1,299.97 | 0.26 | |

| Industrial Products | ||||

| APL Apollo Tubes Ltd | 6,23,374 | 9,981.46 | 1.98 | |

| Kirloskar Oil Engines Ltd | 7,01,012 | 6,338.55 | 1.26 | |

| Cummins India Ltd | 1,74,550 | 6,206.13 | 1.23 | |

| Shivalik Bimetal Controls Ltd | 7,39,719 | 3,927.91 | 0.78 | |

| Timken India Ltd | 1,12,341 | 3,728.49 | 0.74 | |

| Insurance | ||||

| HDFC Life Insurance Co Ltd | 6,35,064 | 4,797.91 | 0.95 | |

| IT - Software | ||||

| Mphasis Ltd* | 5,81,200 | 16,216.64 | 3.22 | |

| Coforge Ltd* | 8,31,486 | 14,536.04 | 2.89 | |

| Zensar Technologies Ltd | 5,72,822 | 4,617.80 | 0.92 | |

| CE Info Systems Ltd | 2,35,860 | 4,250.20 | 0.84 | |

| Leisure Services | ||||

| Lemon Tree Hotels Ltd* | 82,83,597 | 12,408.00 | 2.47 | |

| Devyani International Ltd | 35,10,562 | 5,725.73 | 1.14 | |

| Personal Products | ||||

| Dabur India Ltd | 19,12,325 | 10,116.20 | 2.01 | |

| Petroleum Products | ||||

| Reliance Industries Ltd* | 10,38,222 | 14,433.36 | 2.87 | |

| Hindustan Petroleum Corporation Ltd | 24,67,055 | 10,323.39 | 2.05 | |

| Pharmaceuticals & Biotechnology | ||||

| Eris Lifesciences Ltd | 5,19,474 | 9,344.82 | 1.86 | |

| Cipla Ltd | 5,72,804 | 8,904.81 | 1.77 | |

| Akums Drugs And Pharmaceuticals Ltd | 12,10,258 | 6,284.26 | 1.25 | |

| Biocon Ltd | 13,47,450 | 5,273.92 | 1.05 | |

| Piramal Pharma Ltd | 9,84,055 | 1,938.88 | 0.39 | |

| Power | ||||

| NTPC Ltd | 26,62,564 | 8,899.62 | 1.77 | |

| CESC Ltd | 44,21,264 | 7,494.48 | 1.49 | |

| Realty | ||||

| Brigade Enterprises Ltd | 2,34,210 | 2,360.37 | 0.47 | |

| Godrej Properties Ltd | 66,817 | 1,405.09 | 0.28 | |

| Retailing | ||||

| Eternal Ltd* | 39,41,361 | 12,131.51 | 2.41 | |

| Telecom - Services | ||||

| Bharti Airtel Ltd* | 6,31,637 | 12,091.43 | 2.40 | |

| Indus Towers Ltd* | 31,56,771 | 11,459.08 | 2.28 | |

| Tata Communications Ltd | 2,66,654 | 4,598.98 | 0.91 | |

| Bharti Hexacom Ltd | 1,73,030 | 3,197.08 | 0.64 | |

| Transport Services | ||||

| Interglobe Aviation Ltd | 1,70,988 | 10,106.25 | 2.01 | |

| Ecos India Mobility & Hospitality Ltd | 14,06,358 | 4,335.80 | 0.86 | |

| Total Equity Holdings | 4,82,107.00 | 95.81 | ||

| Total Holdings | 4,82,107.00 | 95.81 | ||

| Call,cash and other current asset | 21,074.33 | 4.19 | ||

| Total Asset | 5,03,181.32 | 100.00 | ||

| * Top 10 holdings | ||||

@ Reverse Repo : 3.30%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 0.89%

Please click here for Product Label & Benchmark Risk-o-meter.