Franklin India Opportunities Fund

As on June 30, 2025

|

Franklin India Opportunities Fund As on June 30, 2025 |

|

|

TYPE OF SCHEME

An open ended equity scheme following special situations theme

SCHEME CATEGORY

Thematic - Special Situations

SCHEME CHARACTERISTICS

Min 80% Equity in Special Situations theme

INVESTMENT OBJECTIVE

To generate capital appreciation by investing in opportunities presented by special situations such as corporate restructuring, Government policy and/or regulatory changes, companies going through temporary unique challenges and other similar instances.

DATE OF ALLOTMENT:

February 21, 2000

FUND MANAGER(S):

Kiran Sebastian & R Janakiraman

Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty 500

EXPENSE RATIO#: 1.76%

EXPENSE RATIO# (DIRECT) : 0.49%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

Different plans have a different expense structure

An open ended equity scheme following special situations theme

SCHEME CATEGORY

Thematic - Special Situations

SCHEME CHARACTERISTICS

Min 80% Equity in Special Situations theme

INVESTMENT OBJECTIVE

To generate capital appreciation by investing in opportunities presented by special situations such as corporate restructuring, Government policy and/or regulatory changes, companies going through temporary unique challenges and other similar instances.

DATE OF ALLOTMENT:

February 21, 2000

FUND MANAGER(S):

Kiran Sebastian & R Janakiraman

Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty 500

| TURNOVER: | |

| Portfolio Turnover | 53.72% |

| VOLATILITY MEASURES (3 YEARS): | |

| Standard Deviation | 4.64% |

| Beta | 0.98 |

| Sharpe Ratio* | 1.84 |

| * Annualised. Risk-free rate assumed to be 5.52% (FBIL OVERNIGHT MIBOR) | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | In respect of each purchase of Units - 1% if the Units are redeemed/switched-out within one year of allotment |

NAV AS OF JUNE 30, 2025

| Growth Plan | Rs 252.3608 |

| IDCW Plan | Rs 39.2323 |

| Direct - Growth Plan | Rs 278.2231 |

| Direct - IDCW Plan | Rs 44.0777 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs7199.55 Crores |

| Monthly Average | Rs 7021.61 Crores |

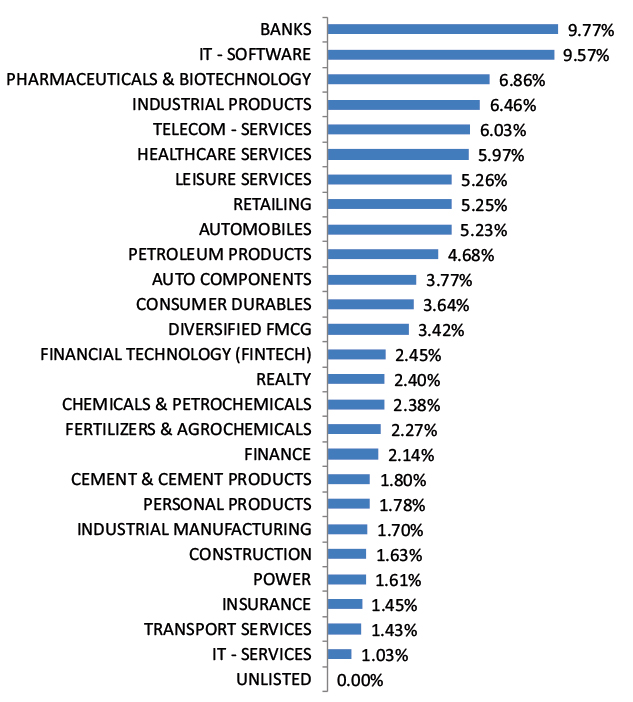

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Auto Components | |||

| Pricol Ltd | 15,63,667 | 7,167.07 | 1.00 |

| Automobiles | |||

| Maruti Suzuki India Ltd* | 1,69,582 | 21,028.17 | 2.92 |

| Mahindra & Mahindra Ltd* | 6,37,966 | 20,307.73 | 2.82 |

| TVS Motor Co Ltd | 2,82,218 | 8,235.12 | 1.14 |

| Tata Motors Ltd | 6,60,862 | 4,546.73 | 0.63 |

| Banks | |||

| HDFC Bank Ltd* | 20,43,971 | 40,910.08 | 5.68 |

| Axis Bank Ltd* | 29,50,277 | 35,379.72 | 4.91 |

| IDFC First Bank Ltd | 1,53,17,159 | 11,157.02 | 1.55 |

| Ujjivan Small Finance Bank Ltd | 1,15,53,370 | 5,664.62 | 0.79 |

| Cement & Cement Products | |||

| Ultratech Cement Ltd | 84,775 | 10,251.84 | 1.42 |

| Chemicals & Petrochemicals | |||

| Sudarshan Chemical Industries Ltd | 14,35,340 | 17,703.48 | 2.46 |

| Camlin Fine Sciences Ltd | 8,89,039 | 2,789.80 | 0.39 |

| Construction | |||

| Larsen & Toubro Ltd | 1,66,745 | 6,119.21 | 0.85 |

| Consumer Durables | |||

| Crompton Greaves Consumer Electricals Ltd | 22,72,055 | 8,069.20 | 1.12 |

| Senco Gold Ltd | 14,95,097 | 5,131.92 | 0.71 |

| Stanley Lifestyles Ltd | 5,28,424 | 1,823.86 | 0.25 |

| Diversified Fmcg | |||

| Hindustan Unilever Ltd* | 11,21,657 | 25,737.54 | 3.57 |

| Godavari Biorefineries Ltd | 2,55,654 | 635.30 | 0.09 |

| Electrical Equipment | |||

| Genus Power Infrastructures Ltd | 3,98,564 | 1,485.85 | 0.21 |

| Fertilizers & Agrochemicals | |||

| UPL Ltd | 19,30,420 | 12,764.90 | 1.77 |

| Financial Technology (Fintech) | |||

| PB Fintech Ltd | 8,33,638 | 15,204.72 | 2.11 |

| Healthcare Services | |||

| Aster DM Healthcare Ltd | 30,49,105 | 18,174.19 | 2.52 |

| Metropolis Healthcare Ltd | 6,16,956 | 10,526.50 | 1.46 |

| Apollo Hospitals Enterprise Ltd | 1,17,160 | 8,484.73 | 1.18 |

| Syngene International Ltd | 9,41,015 | 6,012.14 | 0.84 |

| Industrial Manufacturing | |||

| Syrma SGS Technology Ltd | 20,05,931 | 11,377.64 | 1.58 |

| Industrial Products | |||

| APL Apollo Tubes Ltd | 9,98,385 | 17,362.91 | 2.41 |

| Kirloskar Oil Engines Ltd | 10,01,916 | 8,526.81 | 1.18 |

| Carborundum Universal Ltd | 51,739 | 499.51 | 0.07 |

| Insurance | |||

| HDFC Life Insurance Co Ltd* | 25,60,258 | 20,848.18 | 2.90 |

| IT - Software | |||

| Mphasis Ltd | 7,10,533 | 20,217.51 | 2.81 |

| Intellect Design Arena Ltd | 15,65,470 | 17,985.68 | 2.50 |

| CE Info Systems Ltd | 8,37,502 | 14,737.52 | 2.05 |

| Zensar Technologies Ltd | 7,86,828 | 6,629.42 | 0.92 |

| Leisure Services | |||

| Lemon Tree Hotels Ltd | 1,28,33,401 | 17,980.88 | 2.50 |

| Devyani International Ltd | 45,58,919 | 7,648.50 | 1.06 |

| Paper, Forest & Jute Products | |||

| West Coast Paper Mills Ltd | 1,95,700 | 989.95 | 0.14 |

| Personal Products | |||

| Godrej Consumer Products Ltd | 8,31,075 | 9,793.39 | 1.36 |

| Petroleum Products | |||

| Reliance Industries Ltd* | 30,38,968 | 45,602.75 | 6.33 |

| Pharmaceuticals & Biotechnology | |||

| Cipla Ltd | 9,61,743 | 14,482.89 | 2.01 |

| Akums Drugs And Pharmaceuticals Ltd | 19,41,100 | 11,363.20 | 1.58 |

| Eris Lifesciences Ltd | 4,71,821 | 7,944.52 | 1.10 |

| Biocon Ltd | 18,81,179 | 6,691.35 | 0.93 |

| Piramal Pharma Ltd | 25,55,974 | 5,198.34 | 0.72 |

| Power | |||

| NTPC Ltd* | 63,33,312 | 21,210.26 | 2.95 |

| Realty | |||

| Prestige Estates Projects Ltd | 3,31,956 | 5,501.84 | 0.76 |

| Godrej Properties Ltd | 2,27,077 | 5,320.64 | 0.74 |

| Brigade Enterprises Ltd | 4,34,087 | 4,817.50 | 0.67 |

| Retailing | |||

| Eternal Ltd* | 1,01,30,262 | 26,759.09 | 3.72 |

| Info Edge (India) Ltd | 7,29,836 | 10,862.15 | 1.51 |

| Swiggy Ltd | 11,63,302 | 4,657.86 | 0.65 |

| Telecom - Services | |||

| Bharti Airtel Ltd* | 13,42,233 | 26,973.51 | 3.75 |

| Indus Towers Ltd | 28,08,852 | 11,828.08 | 1.64 |

| Transport Services | |||

| Interglobe Aviation Ltd | 2,36,227 | 14,118.11 | 1.96 |

| Unlisted | |||

| Numero Uno International Ltd | 98,000 | 0.01 | 0.00 |

| Chennai Interactive Business Services Pvt Ltd | 23,815 | 0.00 | 0.00 |

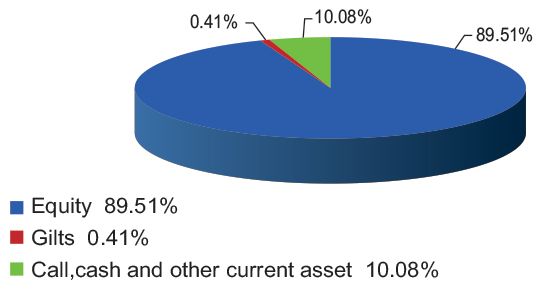

| Total Equity Holdings | 6,83,241.46 | 94.90 | |

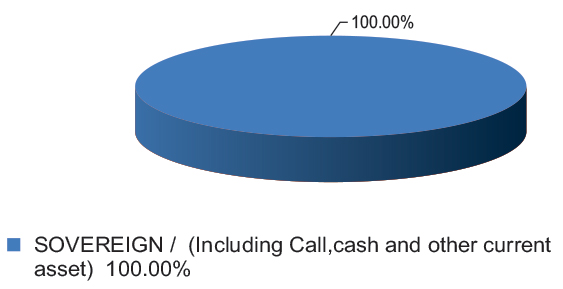

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of Assets |

| 182 DTB (29-AUG-2025) | SOVEREIGN | 2,478.53 | 0.34 |

| Total Gilts | 2,478.53 | 0.34 | |

| Total Debt Holdings | 2,478.53 | 0.34 | |

| Total Holdings | 6,85,719.98 | 95.24 | |

| Call,cash and other current asset | 34,234.74 | 4.76 | |

| Total Asset | 7,19,954.72 | 100.00 | |

| * Top 10 holdings | |||

@ Reverse Repo : 4.82%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : -0.06%

Please click here for Product Label & Benchmark Risk-o-meter.