|

Franklin India Pension Plan$$

As on June 30, 2025 |

|

|

An open ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier)

SCHEME CATEGORY

Retirement Fund

SCHEME CHARACTERISTICS

Lock-in of 5 years or till retirement age,whichever is earlier

INVESTMENT OBJECTIVE

The Fund seeks to provide investors regular income under the Dividend Plan and capital appreciation under the Growth Plan.

DATE OF ALLOTMENT:

March 31, 1997

FUND MANAGER(S):

Anuj Tagra (w.e.f. April 30, 2024) (Debt)

Pallab Roy (w.e.f. March 07, 2024)

Rajasa Kakulavarapu (Equity)

Ajay Argal (w.e.f. October 4, 2024)

BENCHMARK:

CRISIL Short Term Debt Hybrid 60+40 Index (The Benchmark has been changed from 40% Nifty 500+ 60% Crisil Composite Bond Index to CRISIL Short Term Debt Hybrid 60+40 Index w.e.f 12th August, 2024.)

| MATURITY & YIELD$ | |

| RESIDUAL MATURITY / AVERAGE MATURITY | 2.95 years |

| ANNUALISED PORTFOLIO YTM# | 7.09% |

| MODIFIED DURATION | 2.55 years |

| MACAULAY DURATION | 2.72 years |

| #Yields of all securities are in annualised terms $ Calculated based on debt holdings in the portfolio | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 500/1 MINIMUM INVESTMENT FOR SIP

₹ 500/1

ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs500/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | 3%, if redeemed before the

age of 58 years (subject to

lock-in period) and target

amount

Nil, if redeemed after the

age of 58 years

|

| Different plans have a different expense structure

Retirement age : 60 years | ||

| TAX BENEFITS | ||

| Investments will qualify for tax benefit under the Section 80C as per the income tax act | ||

| LOCK-IN PERIOD & MINIMUM

TARGET INVESTMENT | ||

| For investment (including registered SIPs and incoming

STPs) made on or before June 1, 2018: Three (3) full

financial years For investments (including SIPs & STPs

registered) made on or after June 4, 2018: 5 years or till

retirement age (whichever is earlier) Minimum target investment Rs 10,000 before the age of 60 years. | ||

| Growth Plan | Rs 220.2554 |

| IDCW Plan | Rs 18.1153 |

| Direct - Growth Plan | Rs 241.2779 |

| Direct - IDCW Plan | Rs 19.9945 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs 525.99 crores |

| Monthly Average | Rs 523.12 crores |

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Aerospace & Defense | |||

| Bharat Electronics Ltd | 70,000 | 295.05 | 0.56 |

| Agricultural Food & Other Products | |||

| Marico Ltd | 31,800 | 229.71 | 0.44 |

| Auto Components | |||

| Tube Investments of India Ltd | 8,000 | 248.72 | 0.47 |

| Amara Raja Energy And Mobility Ltd | 21,000 | 202.59 | 0.39 |

| ZF Commercial Vehicle Control Systems India Ltd | 1,482 | 198.47 | 0.38 |

| Automobiles | |||

| Maruti Suzuki India Ltd | 3,000 | 372.00 | 0.71 |

| Tata Motors Ltd | 53,000 | 364.64 | 0.69 |

| Banks | |||

| HDFC Bank Ltd* | 1,10,000 | 2,201.65 | 4.19 |

| ICICI Bank Ltd | 1,12,500 | 1,626.53 | 3.09 |

| Axis Bank Ltd | 68,500 | 821.45 | 1.56 |

| State Bank of India | 53,000 | 434.79 | 0.83 |

| Beverages | |||

| United Spirits Ltd | 32,000 | 456.99 | 0.87 |

| Capital Markets | |||

| Angel One Ltd | 2,000 | 58.46 | 0.11 |

| Cement & Cement Products | |||

| Ultratech Cement Ltd | 3,900 | 471.63 | 0.90 |

| Chemicals & Petrochemicals | |||

| Chemplast Sanmar Ltd | 45,000 | 197.57 | 0.38 |

| Commercial Services & Supplies | |||

| Teamlease Services Ltd | 6,000 | 121.87 | 0.23 |

| Construction | |||

| Larsen & Toubro Ltd | 27,100 | 994.52 | 1.89 |

| Consumer Durables | |||

| Crompton Greaves Consumer Electricals Ltd | 93,000 | 330.29 | 0.63 |

| Amber Enterprises India Ltd | 3,365 | 227.79 | 0.43 |

| Diversified Fmcg | |||

| Hindustan Unilever Ltd | 11,500 | 263.88 | 0.50 |

| Ferrous Metals | |||

| Tata Steel Ltd | 1,27,000 | 202.90 | 0.39 |

| Fertilizers & Agrochemicals | |||

| PI Industries Ltd | 307 | 12.60 | 0.02 |

| Finance | |||

| PNB Housing Finance Ltd | 22,000 | 244.07 | 0.46 |

| Cholamandalam Investment and Finance Co Ltd | 6,000 | 97.68 | 0.19 |

| Financial Technology (Fintech) | |||

| PB Fintech Ltd | 21,000 | 383.02 | 0.73 |

| Gas | |||

| GAIL (India) Ltd | 2,00,000 | 381.68 | 0.73 |

| Healthcare Services | |||

| Apollo Hospitals Enterprise Ltd | 6,000 | 434.52 | 0.83 |

| Metropolis Healthcare Ltd | 13,500 | 230.34 | 0.44 |

| Industrial Products | |||

| Kirloskar Oil Engines Ltd | 23,000 | 195.74 | 0.37 |

| Insurance | |||

| HDFC Life Insurance Co Ltd | 48,000 | 390.86 | 0.74 |

| ICICI Lombard General Insurance Co Ltd | 10,000 | 204.02 | 0.39 |

| IT - Software | |||

| Infosys Ltd | 58,000 | 929.04 | 1.77 |

| HCL Technologies Ltd | 41,000 | 708.73 | 1.35 |

| Intellect Design Arena Ltd | 14,888 | 171.05 | 0.33 |

| Leisure Services | |||

| Jubilant Foodworks Ltd | 42,300 | 296.86 | 0.56 |

| Sapphire Foods India Ltd | 78,000 | 256.46 | 0.49 |

| Lemon Tree Hotels Ltd | 1,70,000 | 238.19 | 0.45 |

| Petroleum Products | |||

| Reliance Industries Ltd | 60,000 | 900.36 | 1.71 |

| Pharmaceuticals & Biotechnology | |||

| Sun Pharmaceutical Industries Ltd | 24,000 | 402.17 | 0.76 |

| Eris Lifesciences Ltd | 20,888 | 351.71 | 0.67 |

| Power | |||

| NTPC Ltd | 1,50,000 | 502.35 | 0.96 |

| Realty | |||

| Prestige Estates Projects Ltd | 15,500 | 256.90 | 0.49 |

| Retailing | |||

| Eternal Ltd | 2,00,000 | 528.30 | 1.00 |

| V-Mart Retail Ltd | 24,424 | 209.78 | 0.40 |

| Telecom - Services | |||

| Bharti Airtel Ltd | 48,000 | 964.61 | 1.83 |

| Indus Towers Ltd | 50,000 | 210.55 | 0.40 |

| Textiles & Apparels | |||

| Pearl Global Industries Ltd | 12,992 | 194.54 | 0.37 |

| Transport Services | |||

| Interglobe Aviation Ltd | 5,000 | 298.83 | 0.57 |

| Total Equity Holdings | 20,316.43 | 38.62 | |

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of Assets |

| Jubilant Bevco Ltd* | CRISIL AA | 3,385.20 | 6.44 |

| LIC Housing Finance Ltd* | CARE AAA | 3,067.05 | 5.83 |

| Bajaj Housing Finance Ltd* | CRISIL AAA | 2,586.43 | 4.92 |

| Mahindra & Mahindra Financial Services Ltd* | CRISIL AAA | 2,546.00 | 4.84 |

| Poonawalla Fincorp Ltd* | CRISIL AAA | 2,543.39 | 4.84 |

| Jubilant Beverages Ltd* | CRISIL AA | 1,822.07 | 3.46 |

| Bharti Telecom Ltd | CRISIL AA+ | 1,087.45 | 2.07 |

| LIC Housing Finance Ltd | CRISIL AAA | 515.70 | 0.98 |

| HDFC Bank Ltd | CRISIL AAA | 512.38 | 0.97 |

| Kotak Mahindra Investments Ltd | CRISIL AAA | 511.41 | 0.97 |

| Total Corporate Debt | 18,577.09 | 35.32 | |

| National Bank For Agriculture & Rural Development* | IND AAA | 4,688.77 | 8.91 |

| Small Industries Development Bank Of India* | CRISIL AAA | 2,600.75 | 4.94 |

| National Bank for Financing Infrastructure and Development* | CRISIL AAA | 2,549.28 | 4.85 |

| REC Ltd | CRISIL AAA | 1,390.82 | 2.64 |

| Total PSU/PFI Bonds | 11,229.61 | 21.35 | |

| 7.08% Andhra Pradesh SDL (26-Mar-2037) | SOVEREIGN | 468.83 | 0.89 |

| 7.10% Rajasthan SDL (26-Mar-2043) | SOVEREIGN | 42.35 | 0.08 |

| Total Gilts | 511.19 | 0.97 | |

| Total Debt Holdings | 30,317.88 | 57.64 | |

| Total Holdings | 50,634.31 | 96.26 | |

| Call,cash and other current asset | 1,964.95 | 3.74 | |

| Total Asset | 52,599.26 | 100.00 | |

| * Top 10 holdings | |||

@ Reverse Repo : 3.48%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 0.26%

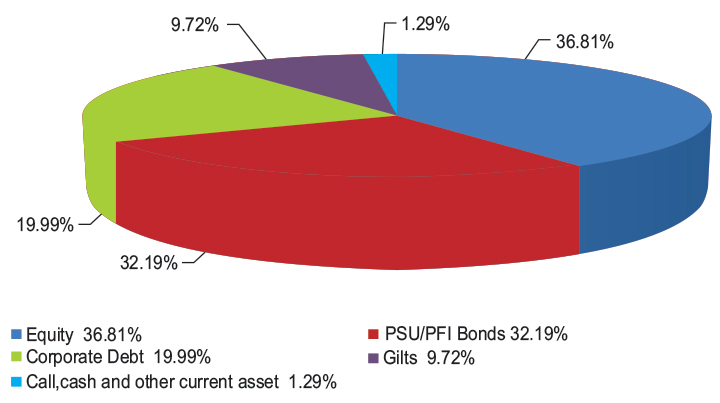

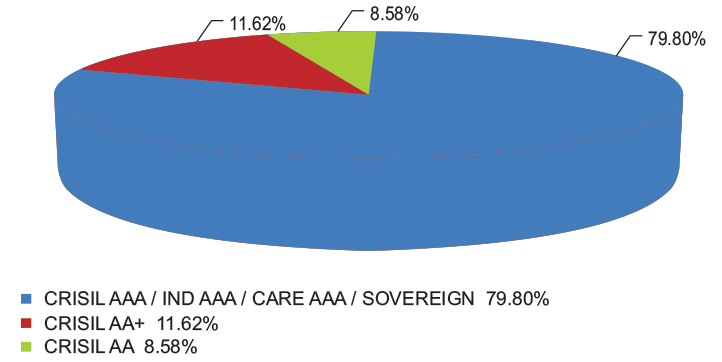

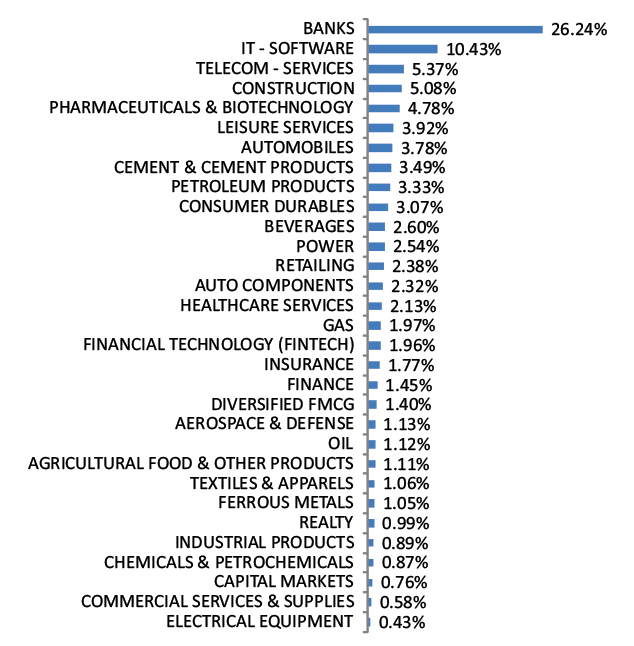

Note : Sector Allocation is provided as a percentage of Equity holding totaling to 100%

Composition by Rating is provided as a percentage of Debt Holding totaling to 100%

Note : Sector Allocation is provided as a percentage of Equity holding totaling to 100%

Composition by Rating is provided as a percentage of Debt Holding totaling to 100%

$$ - Franklin India Pension Plan will be renamed as Franklin India Retirement Fund effective July 11, 2025

This scheme has exposure to floating rate instruments. The duration of these instruments is linked to the interest rate reset period. The interest rate risk in a floating rate instrument or in a fixed rate instrument hedged with derivatives is likely to be lesser than that in an equivalent maturity fixed rate instrument. Under some market circumstances the volatility may be of an order greater than what may ordinarily be expected considering only its duration. Hence investors are recommended to consider the unadjusted portfolio maturity of the scheme as well and exercise adequate due diligence when deciding to make their investments.