Franklin India Mid Cap Fund$$

(Erstwhile Franklin India Prima Fund)As on November 28, 2025

|

Franklin India Mid Cap Fund$$ (Erstwhile Franklin India Prima Fund) As on November 28, 2025 |

|

|

TYPE OF SCHEME

Mid-cap Fund- An open ended equity scheme predominantly investing in mid cap stocks

SCHEME CATEGORY

Mid Cap Fund

SCHEME CHARACTERISTICS

Min 65% Mid Caps

INVESTMENT OBJECTIVE

The investment objective of Prima Fund is to provide medium to longterm capital appreciation as a primary objective and income as a secondary objective.

DATE OF ALLOTMENT:

December 1, 1993

FUND MANAGER(S):

Akhil Kalluri & R Janakiraman

Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty Midcap 150

EXPENSE RATIO#: 1.76%

EXPENSE RATIO# (DIRECT) : 0.98%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

Different plans have a different expense structure

Mid-cap Fund- An open ended equity scheme predominantly investing in mid cap stocks

SCHEME CATEGORY

Mid Cap Fund

SCHEME CHARACTERISTICS

Min 65% Mid Caps

INVESTMENT OBJECTIVE

The investment objective of Prima Fund is to provide medium to longterm capital appreciation as a primary objective and income as a secondary objective.

DATE OF ALLOTMENT:

December 1, 1993

FUND MANAGER(S):

Akhil Kalluri & R Janakiraman

Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

Nifty Midcap 150

| TURNOVER: | |

| Portfolio Turnover | 28.63% |

| VOLATILITY MEASURES (3 YEARS): | |

| Standard Deviation | 4.25% |

| Beta | 0.88 |

| Sharpe Ratio* | 1.09 |

| * Annualised. Risk-free rate assumed to be 5.59% (FBIL OVERNIGHT MIBOR) | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | In respect of each purchase of Units - 1% if the Units are redeemed/switched-out within one year of allotment |

NAV AS OF NOVEMBER 28, 2025

| Growth Plan | Rs2824.6538 |

| IDCW Plan | Rs 95.8994 |

| Direct - Growth Plan | Rs3184.6686 |

| Direct - IDCW Plan | Rs115.6787 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs12911.38 crores |

| Monthly Average | Rs 12828.85 crores |

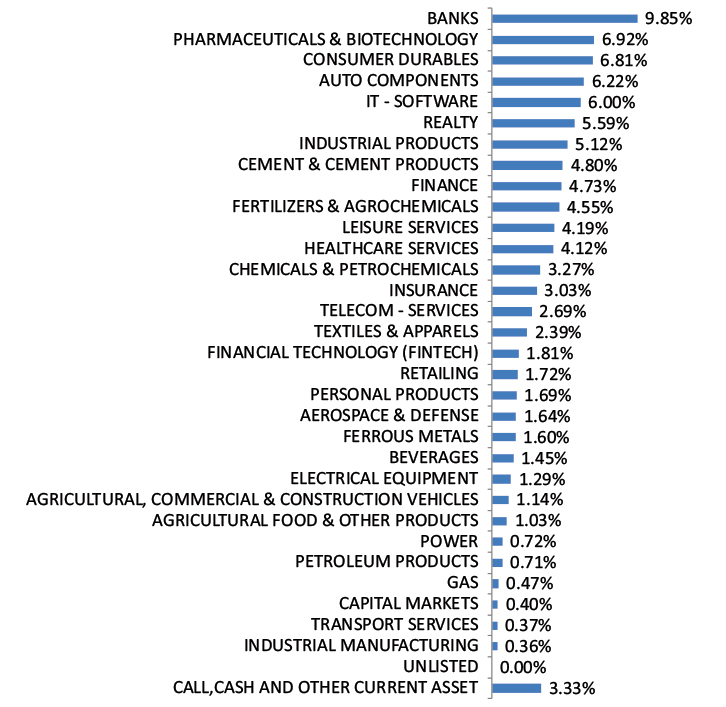

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets | |

| Aerospace & Defense | ||||

| Bharat Electronics Ltd | 33,67,750 | 13,866.71 | 1.07 | |

| Hindustan Aeronautics Ltd | 2,81,300 | 12,777.77 | 0.99 | |

| Agricultural Food & Other Products | ||||

| Marico Ltd | 18,00,000 | 12,913.20 | 1.00 | |

| Agricultural, Commercial & Construction Vehicles | ||||

| Escorts Kubota Ltd | 5,00,909 | 19,121.70 | 1.48 | |

| Ashok Leyland Ltd | 66,33,520 | 10,488.92 | 0.81 | |

| Auto Components | ||||

| Balkrishna Industries Ltd | 7,00,000 | 16,162.30 | 1.25 | |

| Tube Investments of India Ltd | 5,41,027 | 15,064.36 | 1.17 | |

| Motherson Sumi Wiring India Ltd | 2,62,04,805 | 11,965.11 | 0.93 | |

| Exide Industries Ltd | 28,03,019 | 10,505.72 | 0.81 | |

| Uno Minda Ltd | 5,71,023 | 7,462.13 | 0.58 | |

| Apollo Tyres Ltd | 12,00,000 | 6,168.00 | 0.48 | |

| ZF Commercial Vehicle Control Systems India Ltd | 46,342 | 6,119.00 | 0.47 | |

| Sundram Fasteners Ltd | 5,00,000 | 4,673.75 | 0.36 | |

| Automobiles | ||||

| Hero MotoCorp Ltd | 1,40,287 | 8,662.02 | 0.67 | |

| Banks | ||||

| Federal Bank Ltd* | 1,63,24,683 | 42,104.62 | 3.26 | |

| IDFC First Bank Ltd* | 2,88,93,177 | 23,152.10 | 1.79 | |

| HDFC Bank Ltd | 19,46,350 | 19,611.42 | 1.52 | |

| City Union Bank Ltd | 60,78,909 | 16,478.71 | 1.28 | |

| Equitas Small Finance Bank Ltd | 2,35,80,355 | 15,129.16 | 1.17 | |

| State Bank of India | 13,32,729 | 13,047.42 | 1.01 | |

| Beverages | ||||

| United Breweries Ltd | 8,28,517 | 14,006.91 | 1.08 | |

| Capital Markets | ||||

| Billionbrains Garage Ventures Ltd | 1,15,54,840 | 18,358.33 | 1.42 | |

| Angel One Ltd | 2,00,000 | 5,407.60 | 0.42 | |

| Cement & Cement Products | ||||

| J.K. Cement Ltd | 3,37,051 | 19,407.40 | 1.50 | |

| The Ramco Cements Ltd | 12,78,181 | 13,261.13 | 1.03 | |

| ACC Ltd | 2,40,275 | 4,446.53 | 0.34 | |

| Chemicals & Petrochemicals | ||||

| Deepak Nitrite Ltd | 11,00,123 | 17,146.52 | 1.33 | |

| SRF Ltd | 5,30,000 | 15,514.69 | 1.20 | |

| Consumer Durables | ||||

| Kalyan Jewellers India Ltd | 35,63,102 | 18,006.14 | 1.39 | |

| Crompton Greaves Consumer Electricals Ltd | 63,91,052 | 16,958.66 | 1.31 | |

| Dixon Technologies (India) Ltd | 95,340 | 13,920.59 | 1.08 | |

| LG Electronics India Ltd | 3,61,518 | 5,998.67 | 0.46 | |

| Kajaria Ceramics Ltd | 4,95,000 | 5,282.64 | 0.41 | |

| Electrical Equipment | ||||

| Emmvee Photovoltaic Power Ltd | 57,51,488 | 12,495.68 | 0.97 | |

| CG Power and Industrial Solutions Ltd | 18,45,695 | 12,419.68 | 0.96 | |

| Siemens Energy India ltd | 2,25,000 | 7,109.10 | 0.55 | |

| Suzlon Energy Ltd | 1,00,00,000 | 5,401.00 | 0.42 | |

| Ferrous Metals | ||||

| Tata Steel Ltd | 1,08,50,000 | 18,223.66 | 1.41 | |

| Fertilizers & Agrochemicals | ||||

| Coromandel International Ltd | 5,77,620 | 13,759.49 | 1.07 | |

| PI Industries Ltd | 3,74,936 | 12,731.33 | 0.99 | |

| UPL Ltd | 16,75,000 | 12,707.39 | 0.98 | |

| Finance | ||||

| Mahindra & Mahindra Financial Services Ltd* | 86,14,462 | 32,032.88 | 2.48 | |

| SBI Cards and Payment Services Ltd | 16,93,767 | 14,907.69 | 1.15 | |

| PNB Housing Finance Ltd | 14,00,001 | 12,674.21 | 0.98 | |

| HDB Financial Services Ltd | 12,25,000 | 9,398.20 | 0.73 | |

| L&T Finance Ltd | 30,00,000 | 9,370.50 | 0.73 | |

| REC Ltd | 22,00,000 | 7,939.80 | 0.61 | |

| Financial Technology (Fintech) | ||||

| PB Fintech Ltd* | 13,00,578 | 23,656.21 | 1.83 | |

| Healthcare Services | ||||

| Aster DM Healthcare Ltd | 24,07,002 | 16,017.39 | 1.24 | |

| Apollo Hospitals Enterprise Ltd | 1,80,000 | 13,203.90 | 1.02 | |

| Max Healthcare Institute Ltd | 8,26,886 | 9,615.03 | 0.74 | |

| Industrial Products | ||||

| Cummins India Ltd* | 7,17,366 | 32,132.98 | 2.49 | |

| APL Apollo Tubes Ltd* | 14,99,891 | 25,781.63 | 2.00 | |

| Astral Ltd | 7,75,000 | 11,166.20 | 0.86 | |

| Timken India Ltd | 2,57,371 | 8,118.51 | 0.63 | |

| Insurance | ||||

| Max Financial Services Ltd | 12,57,487 | 21,403.69 | 1.66 | |

| ICICI Lombard General Insurance Co Ltd | 8,50,000 | 16,749.25 | 1.30 | |

| IT - Software | ||||

| Mphasis Ltd* | 10,52,885 | 29,600.81 | 2.29 | |

| Coforge Ltd* | 12,14,825 | 23,187.36 | 1.80 | |

| Persistent Systems Ltd | 2,67,491 | 16,993.70 | 1.32 | |

| Hexaware Technologies Ltd | 12,98,978 | 9,830.02 | 0.76 | |

| Leisure Services | ||||

| Jubilant Foodworks Ltd | 18,37,180 | 11,050.64 | 0.86 | |

| ITC Hotels Ltd | 51,93,530 | 10,838.90 | 0.84 | |

| Indian Hotels Co Ltd | 13,02,118 | 9,691.66 | 0.75 | |

| Devyani International Ltd | 52,17,419 | 7,076.91 | 0.55 | |

| Personal Products | ||||

| Emami Ltd | 29,76,225 | 15,788.87 | 1.22 | |

| Procter & Gamble Hygiene and Health Care Ltd | 88,662 | 11,309.72 | 0.88 | |

| Petroleum Products | ||||

| Hindustan Petroleum Corporation Ltd | 30,93,002 | 14,150.48 | 1.10 | |

| Pharmaceuticals & Biotechnology | ||||

| Biocon Ltd* | 58,62,280 | 23,352.39 | 1.81 | |

| IPCA Laboratories Ltd | 14,73,633 | 21,413.36 | 1.66 | |

| Abbott India Ltd | 52,304 | 15,730.43 | 1.22 | |

| Alkem Laboratories Ltd | 2,34,107 | 13,308.98 | 1.03 | |

| Ajanta Pharma Ltd | 3,92,457 | 10,050.04 | 0.78 | |

| Anthem Biosciences Ltd | 4,09,407 | 2,598.51 | 0.20 | |

| Power | ||||

| Tata Power Co Ltd | 32,00,000 | 12,483.20 | 0.97 | |

| Realty | ||||

| Prestige Estates Projects Ltd* | 16,31,918 | 27,372.16 | 2.12 | |

| Phoenix Mills Ltd | 11,32,124 | 19,662.73 | 1.52 | |

| Oberoi Realty Ltd | 9,73,135 | 16,029.48 | 1.24 | |

| Godrej Properties Ltd | 7,25,956 | 15,351.07 | 1.19 | |

| Retailing | ||||

| Trent Ltd | 2,93,937 | 12,493.50 | 0.97 | |

| Vishal Mega Mart Ltd | 60,91,030 | 8,271.62 | 0.64 | |

| Lenskart Solutions Ltd | 3,63,420 | 1,491.66 | 0.12 | |

| Telecom - Services | ||||

| Bharti Hexacom Ltd | 10,55,479 | 18,664.04 | 1.45 | |

| Tata Communications Ltd | 8,84,291 | 16,051.65 | 1.24 | |

| Indus Towers Ltd | 34,38,655 | 13,790.73 | 1.07 | |

| Textiles & Apparels | ||||

| Page Industries Ltd | 38,500 | 14,753.20 | 1.14 | |

| K.P.R. Mill Ltd | 12,00,000 | 12,954.00 | 1.00 | |

| Transport Services | ||||

| Container Corporation Of India Ltd | 15,12,125 | 7,730.74 | 0.60 | |

| Unlisted | ||||

| Numero Uno International Ltd | 8,100 | 0.00 | 0.00 | |

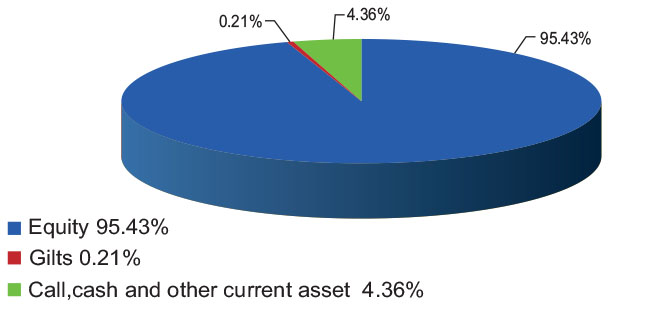

| Total Equity Holdings | 12,55,277.85 | 97.22 | ||

| Company Name | Company Ratings | Market Value (including accrued interest, if any) (Rs. in Lakhs) | % of Assets | |

| 182 DTB (22-JAN-2026) | SOVEREIGN | 2,480.26 | 0.19 | |

| Total Gilts | 2,480.26 | 0.19 | ||

| Total Debt Holdings | 2,480.26 | 0.19 | ||

| Total Holdings | 12,57,758.10 | 97.41 | ||

| Call,cash and other current asset | 33,379.61 | 2.59 | ||

| Total Asset | 12,91,137.71 | 100.00 | ||

| * Top 10 holdings | ||||

@ Reverse Repo : 2.69%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : -0.10%

$$ - Franklin India Prima Fund has been renamed as Franklin India Mid Cap Fund effective July 11, 2025

Please click here for Product Label & Benchmark Risk-o-meter.