Franklin India ELSS Tax Saver Fund

(Erstwhile Franklin India Taxshield)$$

As on June 30, 2025

This is a Simple and Performing scheme which is eligible for distribution by new cadre of distributors.

|

Franklin India ELSS Tax Saver Fund (Erstwhile Franklin India Taxshield)$$ This is a Simple and Performing scheme which is eligible for distribution by new cadre of distributors. As on June 30, 2025 |

|

|

TYPE OF SCHEME

An Open-End Equity Linked Savings Scheme

SCHEME CATEGORY

ELSS

SCHEME CHARACTERISTICS

Min 80% Equity with a statutory lock in of 3 years & tax benefit

INVESTMENT OBJECTIVE

The primary objective for Franklin India ELSS Tax Saver Fund is to provide medium to long term growth of capital along with income tax rebate.

DATE OF ALLOTMENT:

April 10, 1999

FUND MANAGER(S):

R. Janakiraman & Rajasa Kakulavarapu (w.e.f December 1, 2023)

BENCHMARK:

Nifty 500

EXPENSE RATIO#: 1.80%

EXPENSE RATIO# (DIRECT) : 1.01%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 500/500 MINIMUM INVESTMENT FOR SIP

Rs 500/500 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs500/500 LOAD STRUCTURE:

Different plans have a different expense

structure

TAX BENEFITS

LOCK-IN-PERIOD

An Open-End Equity Linked Savings Scheme

SCHEME CATEGORY

ELSS

SCHEME CHARACTERISTICS

Min 80% Equity with a statutory lock in of 3 years & tax benefit

INVESTMENT OBJECTIVE

The primary objective for Franklin India ELSS Tax Saver Fund is to provide medium to long term growth of capital along with income tax rebate.

DATE OF ALLOTMENT:

April 10, 1999

FUND MANAGER(S):

R. Janakiraman & Rajasa Kakulavarapu (w.e.f December 1, 2023)

BENCHMARK:

Nifty 500

| TURNOVER: | |

| Portfolio Turnover | 15.80% |

| VOLATILITY MEASURES (3 YEARS): | |

| Standard Deviation | 3.81% |

| Beta | 0.90 |

| Sharpe Ratio* | 1.47 |

| * Annualised. Risk-free rate assumed to be 5.52% (FBIL OVERNIGHT MIBOR) | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 500/500 MINIMUM INVESTMENT FOR SIP

Rs 500/500 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs500/500 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | Nil |

TAX BENEFITS

| Investments will qualify for tax benefits under the section 80C as per the income tax act. |

| All subscriptions in FIT are subject to a lock-in-period of 3 years from the date of allotment and unit holder cannot redeem, transfer, assign or pledge the units during the period. |

| Scheme specific risk factors: All investments in Franklin India ELSS Tax

Saver Fund are subject to a lock-in-period of 3 years from the date of

respective allotment and the unit holders cannot redeem, transfer, assign or

pledge the units during this period. The Trustee, AMC, their directors of their

employees shall not be liable for any of the tax consequences that may arise,

in the event that the equity Linked Saving Scheme is wound up before the

completion of the lock-in period. Investors are requested to review the prospectus carefully and obtain expert professional advice with regard to specific legal, tax and financial implications of the investment/participation in the scheme |

NAV AS OF JUNE 30, 2025

| Growth Plan | Rs 1506.0928 |

| IDCW Plan | Rs 68.2654 |

| Direct - Growth Plan | Rs1678.5158 |

| Direct - IDCW Plan | Rs79.1061 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs6883.11 crores |

| Monthly Average | Rs6786.77 crores |

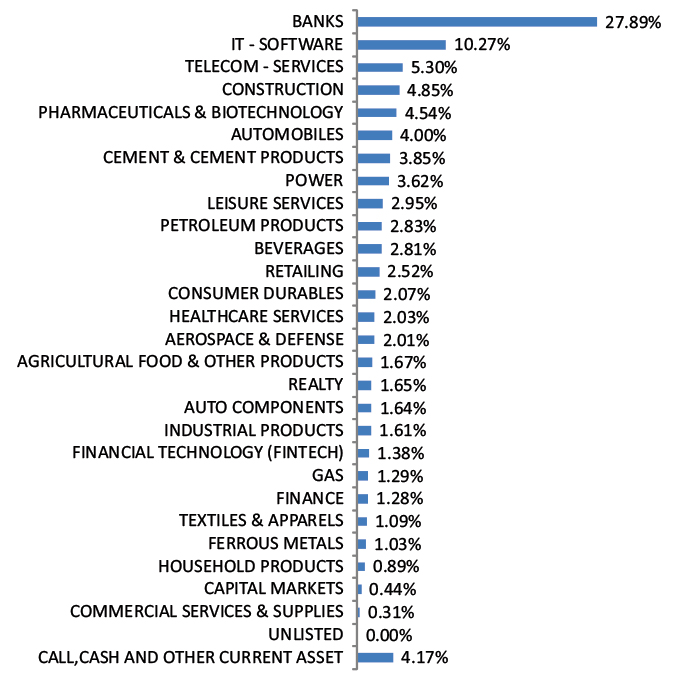

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Aerospace & Defense | |||

| Bharat Electronics Ltd | 42,32,579 | 17,840.32 | 2.59 |

| Agricultural Food & Other Products | |||

| Marico Ltd | 16,33,734 | 11,801.28 | 1.71 |

| Auto Components | |||

| Tube Investments of India Ltd | 2,41,214 | 7,499.34 | 1.09 |

| Amara Raja Energy And Mobility Ltd | 3,74,730 | 3,615.02 | 0.53 |

| Automobiles | |||

| Tata Motors Ltd | 20,61,397 | 14,182.41 | 2.06 |

| Mahindra & Mahindra Ltd | 3,42,937 | 10,916.37 | 1.59 |

| Hyundai Motor India Ltd | 1,74,054 | 3,863.48 | 0.56 |

| Banks | |||

| ICICI Bank Ltd* | 45,46,914 | 65,739.28 | 9.55 |

| HDFC Bank Ltd* | 32,60,417 | 65,257.25 | 9.48 |

| Axis Bank Ltd* | 22,52,948 | 27,017.35 | 3.93 |

| Kotak Mahindra Bank Ltd* | 9,17,310 | 19,846.00 | 2.88 |

| State Bank of India | 13,10,706 | 10,752.38 | 1.56 |

| Beverages | |||

| United Spirits Ltd | 12,76,457 | 18,229.08 | 2.65 |

| Cement & Cement Products | |||

| Grasim Industries Ltd | 6,85,013 | 19,485.19 | 2.83 |

| JK Lakshmi Cement Ltd | 4,35,188 | 3,914.30 | 0.57 |

| The Ramco Cements Ltd | 3,57,700 | 3,845.99 | 0.56 |

| Commercial Services & Supplies | |||

| Teamlease Services Ltd | 1,10,000 | 2,234.32 | 0.32 |

| Construction | |||

| Larsen & Toubro Ltd* | 8,83,853 | 32,435.64 | 4.71 |

| Consumer Durables | |||

| Kalyan Jewellers India Ltd | 14,36,020 | 7,982.12 | 1.16 |

| Ferrous Metals | |||

| Tata Steel Ltd | 42,28,993 | 6,756.24 | 0.98 |

| Fertilizers & Agrochemicals | |||

| PI Industries Ltd | 90,449 | 3,712.66 | 0.54 |

| Finance | |||

| Cholamandalam Investment and Finance Co Ltd | 5,34,037 | 8,694.12 | 1.26 |

| Financial Technology (Fintech) | |||

| PB Fintech Ltd | 5,50,412 | 10,038.96 | 1.46 |

| Gas | |||

| GAIL (India) Ltd | 54,78,497 | 10,455.16 | 1.52 |

| Healthcare Services | |||

| Apollo Hospitals Enterprise Ltd | 1,94,847 | 14,110.82 | 2.05 |

| Household Products | |||

| Jyothy Labs Ltd | 17,23,096 | 5,964.50 | 0.87 |

| Industrial Products | |||

| Kirloskar Oil Engines Ltd | 10,12,130 | 8,613.73 | 1.25 |

| SKF India Ltd | 76,241 | 3,671.61 | 0.53 |

| IT - Software | |||

| Infosys Ltd* | 19,22,741 | 30,798.47 | 4.47 |

| HCL Technologies Ltd* | 14,62,587 | 25,282.28 | 3.67 |

| Intellect Design Arena Ltd | 6,63,201 | 7,619.52 | 1.11 |

| Leisure Services | |||

| Jubilant Foodworks Ltd | 11,80,000 | 8,281.24 | 1.20 |

| Devyani International Ltd | 42,00,152 | 7,046.60 | 1.02 |

| Lemon Tree Hotels Ltd | 36,45,399 | 5,107.57 | 0.74 |

| Petroleum Products | |||

| Reliance Industries Ltd* | 14,72,922 | 22,102.67 | 3.21 |

| Pharmaceuticals & Biotechnology | |||

| Lupin Ltd | 4,29,940 | 8,332.24 | 1.21 |

| Sun Pharmaceutical Industries Ltd | 4,47,035 | 7,490.97 | 1.09 |

| Eris Lifesciences Ltd | 4,43,906 | 7,474.49 | 1.09 |

| Cipla Ltd | 4,25,000 | 6,400.08 | 0.93 |

| Power | |||

| NTPC Ltd | 35,81,067 | 11,992.99 | 1.74 |

| Tata Power Co Ltd | 29,01,618 | 11,764.61 | 1.71 |

| Realty | |||

| Prestige Estates Projects Ltd | 4,16,138 | 6,897.07 | 1.00 |

| Godrej Properties Ltd | 2,62,365 | 6,147.47 | 0.89 |

| Retailing | |||

| Eternal Ltd* | 75,00,000 | 19,811.25 | 2.88 |

| MedPlus Health Services Ltd | 1,22,459 | 1,107.64 | 0.16 |

| Telecom - Services | |||

| Bharti Airtel Ltd* | 15,17,753 | 30,500.76 | 4.43 |

| Indus Towers Ltd | 10,08,586 | 4,247.16 | 0.62 |

| Transport Services | |||

| Interglobe Aviation Ltd | 1,04,073 | 6,219.92 | 0.90 |

| Unlisted | |||

| HDB Financial Services Ltd @@ | 2,36,760 | 1,752.02 | 0.25 |

| Globsyn Technologies Ltd | 3,000 | 0.00 | 0.00 |

| Numero Uno International Ltd | 2,900 | 0.00 | 0.00 |

| Total Equity Holdings | 6,54,851.94 | 95.14 | |

| Total Holdings | 6,54,851.94 | 95.14 | |

| Call,cash and other current asset | 33,459.07 | 4.86 | |

| Total Asset | 6,88,311.01 | 100.00 | |

| @@ Awaiting Listing | * Top 10 holdings | ||

@ Reverse Repo : 2.63%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 2.23%

$$ - Franklin India Taxshield Fund is renamed as Franklin India ELSS Tax Saver Fund effective Dec 22, 2023

Please click here for Product Label & Benchmark Risk-o-meter.