Franklin India Technology Fund

As on May 30, 2025

|

Franklin India Technology Fund As on May 30, 2025 |

|

|

TYPE OF SCHEME

An open ended equity scheme following Technology theme

SCHEME CATEGORY

Thematic - Technology

SCHEME CHARACTERISTICS

Min 80% Equity in technology theme

INVESTMENT OBJECTIVE

To provide long-term capital appreciation by predominantly investing in equity and equity related securities of technology and technology related companies.

DATE OF ALLOTMENT:

August 22, 1998

FUND MANAGER(S):

R. Janakiraman (w.e.f December 1, 2023) & Venkatesh Sanjeevi (w.e.f. October 4, 2024)

Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

BSE Teck (w.e.f. 01st June, 2024)

The Benchmark name is renamed from S&P BSE Teck TRI to BSE Teck w.e.f. 01st June, 2024.

EXPENSE RATIO#: 2.04%

EXPENSE RATIO# (DIRECT) : 0.99%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

Different plans have a different expense structure

An open ended equity scheme following Technology theme

SCHEME CATEGORY

Thematic - Technology

SCHEME CHARACTERISTICS

Min 80% Equity in technology theme

INVESTMENT OBJECTIVE

To provide long-term capital appreciation by predominantly investing in equity and equity related securities of technology and technology related companies.

DATE OF ALLOTMENT:

August 22, 1998

FUND MANAGER(S):

R. Janakiraman (w.e.f December 1, 2023) & Venkatesh Sanjeevi (w.e.f. October 4, 2024)

Sandeep Manam (dedicated for making investments for Foreign Securities)

BENCHMARK:

BSE Teck (w.e.f. 01st June, 2024)

The Benchmark name is renamed from S&P BSE Teck TRI to BSE Teck w.e.f. 01st June, 2024.

| TURNOVER | |

| Portfolio Turnover | 55.20% |

| VOLATILITY MEASURES (3 YEARS): | |

| Standard Deviation | 4.96% |

| Beta | 0.90 |

| Sharpe Ratio* | 0.80 |

| * Annualised. Risk-free rate assumed to be 5.86% (FBIL OVERNIGHT MIBOR) | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | 1% if redeemed/switched-out within one year of allotment. |

NAV AS OF MAY 30, 2025

| Growth Plan | Rs 501.2393 |

| IDCW Plan | Rs46.8804 |

| Direct - Growth Plan | Rs 551.1141 |

| Direct - IDCW Plan | Rs 52.2780 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs1862.37 Crores |

| Monthly Average | Rs1821.21 Crores |

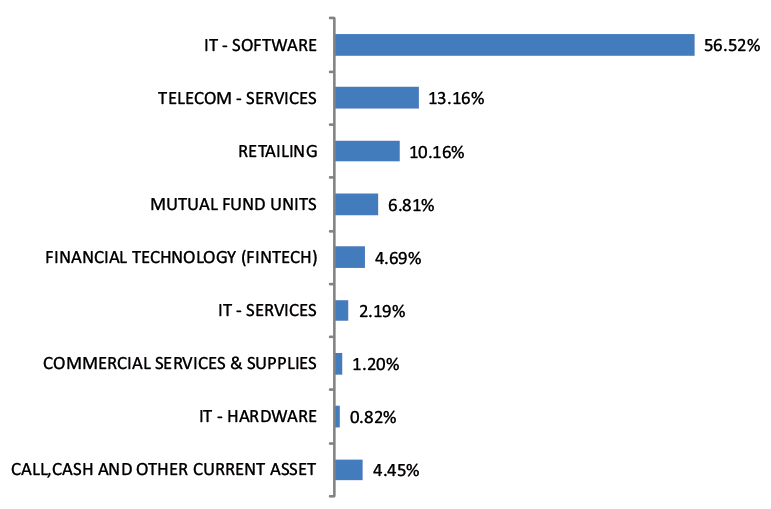

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Commercial Services & Supplies | |||

| Teamlease Services Ltd | 1,09,389 | 2,139.32 | 1.15 |

| Tracxn Technologies Ltd | 2,25,366 | 129.47 | 0.07 |

| Financial Technology (Fintech) | |||

| PB Fintech Ltd* | 5,17,479 | 9,115.91 | 4.89 |

| IT - Hardware | |||

| Apple INC (USA) | 7,579 | 1,303.03 | 0.70 |

| IT - Services | |||

| Cognizant Technology Solutions Corp., A (USA) | 30,839 | 2,137.98 | 1.15 |

| Affle 3i Ltd | 1,13,723 | 1,973.78 | 1.06 |

| IT - Software | |||

| Infosys Ltd* | 22,42,479 | 35,043.22 | 18.82 |

| Tata Consultancy Services Ltd* | 7,64,559 | 26,479.74 | 14.22 |

| Intellect Design Arena Ltd* | 5,43,133 | 6,368.51 | 3.42 |

| HCL Technologies Ltd* | 3,87,170 | 6,336.42 | 3.40 |

| Zensar Technologies Ltd* | 6,42,259 | 5,350.34 | 2.87 |

| Coforge Ltd | 51,512 | 4,404.53 | 2.37 |

| Hexaware Technologies Ltd | 3,91,472 | 3,356.87 | 1.80 |

| Rategain Travel Technologies Ltd | 6,31,875 | 2,804.26 | 1.51 |

| CE Info Systems Ltd | 1,44,535 | 2,798.49 | 1.50 |

| Birlasoft Ltd | 6,41,927 | 2,570.92 | 1.38 |

| Mphasis Ltd | 70,767 | 1,810.79 | 0.97 |

| Tanla Platforms Ltd | 2,86,871 | 1,777.31 | 0.95 |

| Meta Platforms INC (USA) | 3,083 | 1,708.75 | 0.92 |

| Microsoft Corp (USA) | 3,802 | 1,498.24 | 0.80 |

| Alphabet Inc (USA) | 9,122 | 1,341.01 | 0.72 |

| Retailing | |||

| Eternal Ltd* | 53,67,142 | 12,790.44 | 6.87 |

| Swiggy Ltd* | 13,46,780 | 4,485.45 | 2.41 |

| Info Edge (India) Ltd | 1,26,730 | 1,809.07 | 0.97 |

| Amazon.com INC (USA) | 8,181 | 1,435.66 | 0.77 |

| Telecom - Services | |||

| Bharti Airtel Ltd* | 14,55,827 | 27,023.06 | 14.51 |

| Total Equity Holdings | 1,67,992.56 | 90.20 | |

| Mutual Fund Units | |||

| Franklin Technology Fund, Class I (Acc)* | 2,15,810 | 13,832.76 | 7.43 |

| Total Mutual Fund Units | 13,832.76 | 7.43 | |

| Total Holdings | 1,81,825.32 | 97.63 | |

| Call,cash and other current asset | 4,411.24 | 2.37 | |

| Total Asset | 1,86,236.56 | 100.00 | |

| * Top 10 holdings | |||

@ Reverse Repo : 2.26%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 0.11%

Please click here for Product Label & Benchmark Risk-o-meter.