Market Review

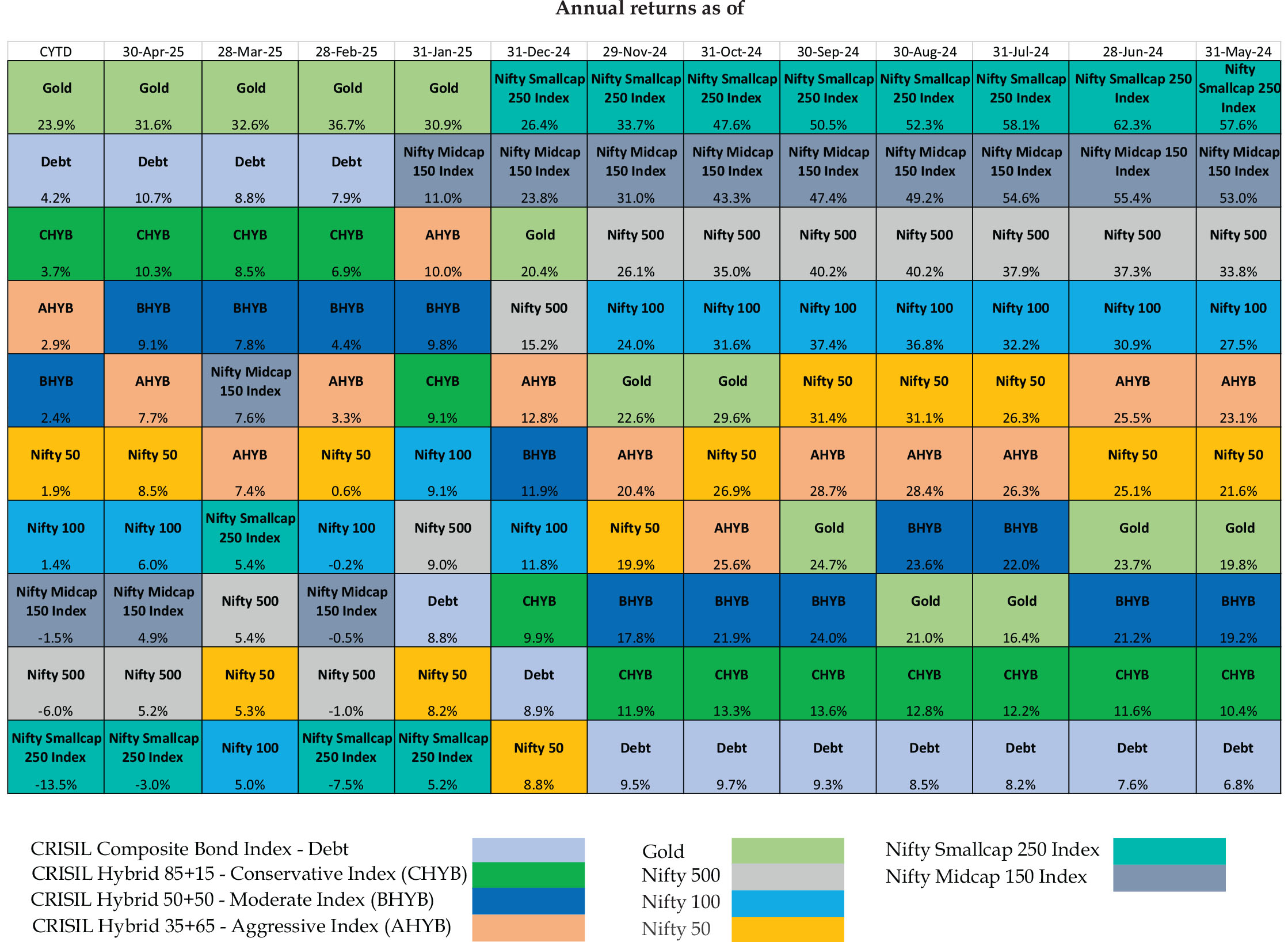

Asset class performance trends

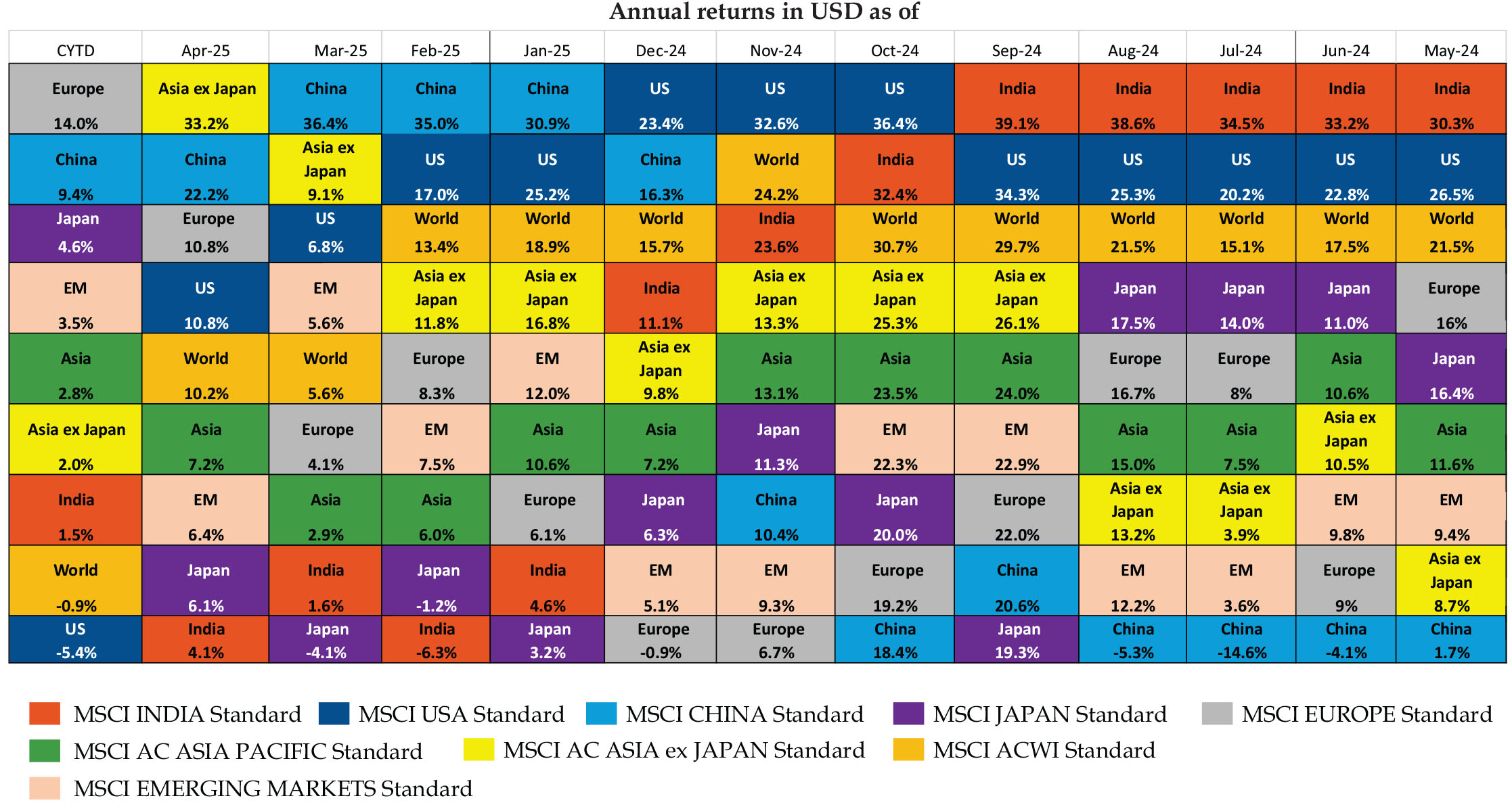

Geographical performance trends based on MSCI country level Indices

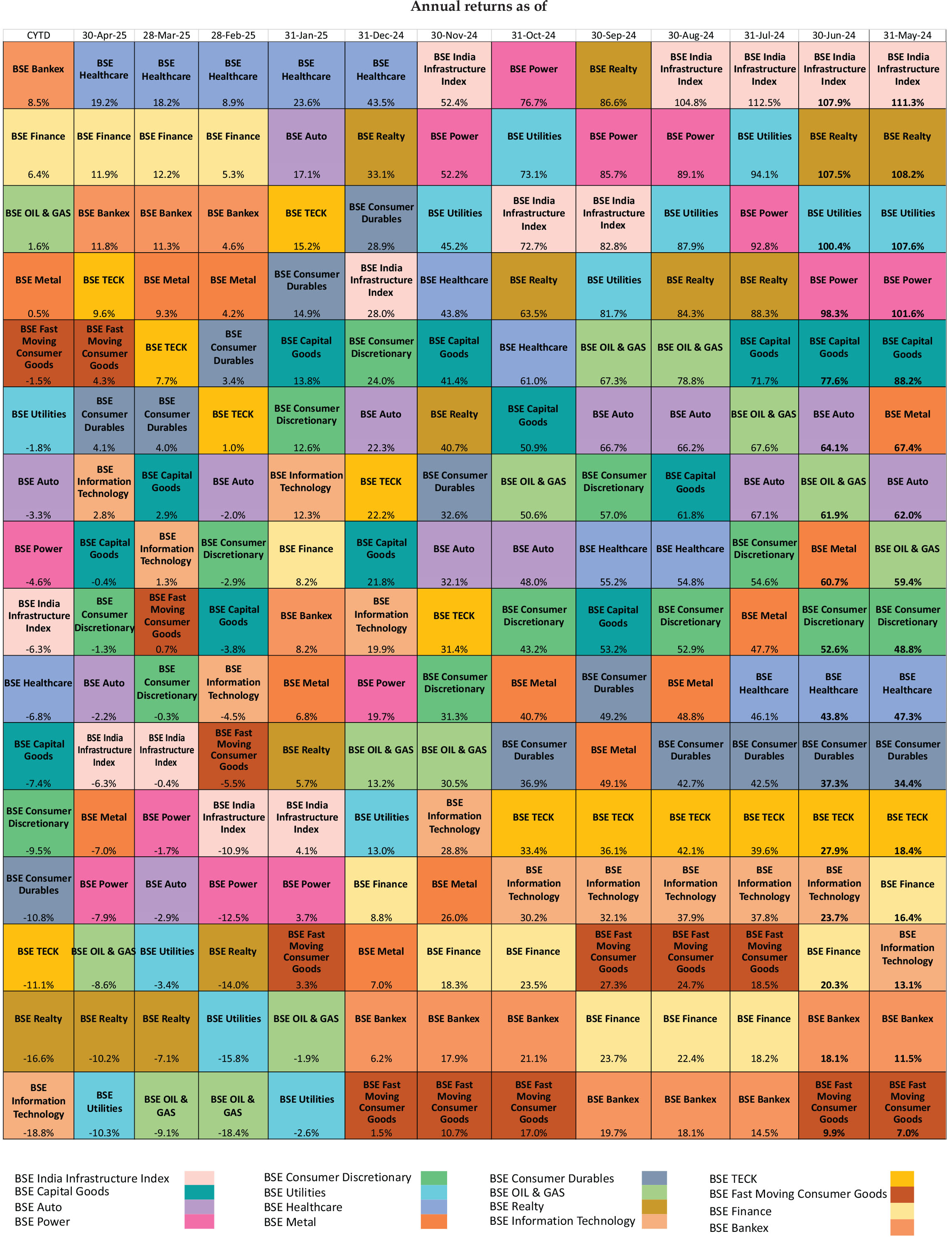

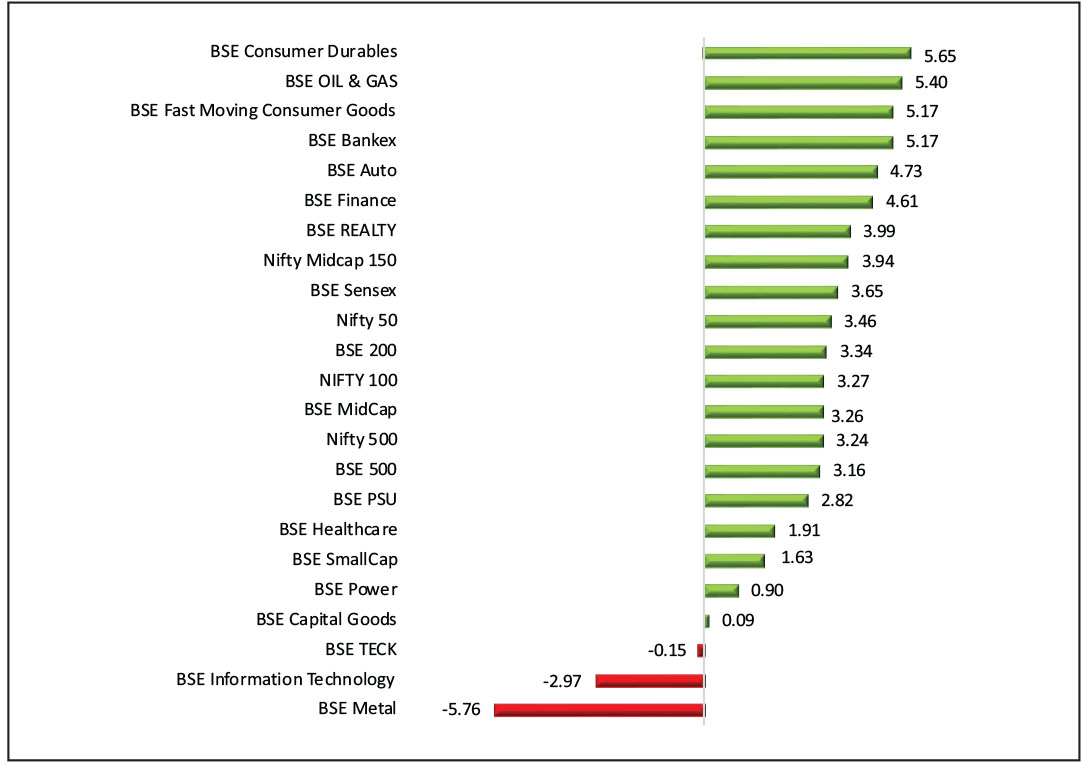

Sectoral performance trends

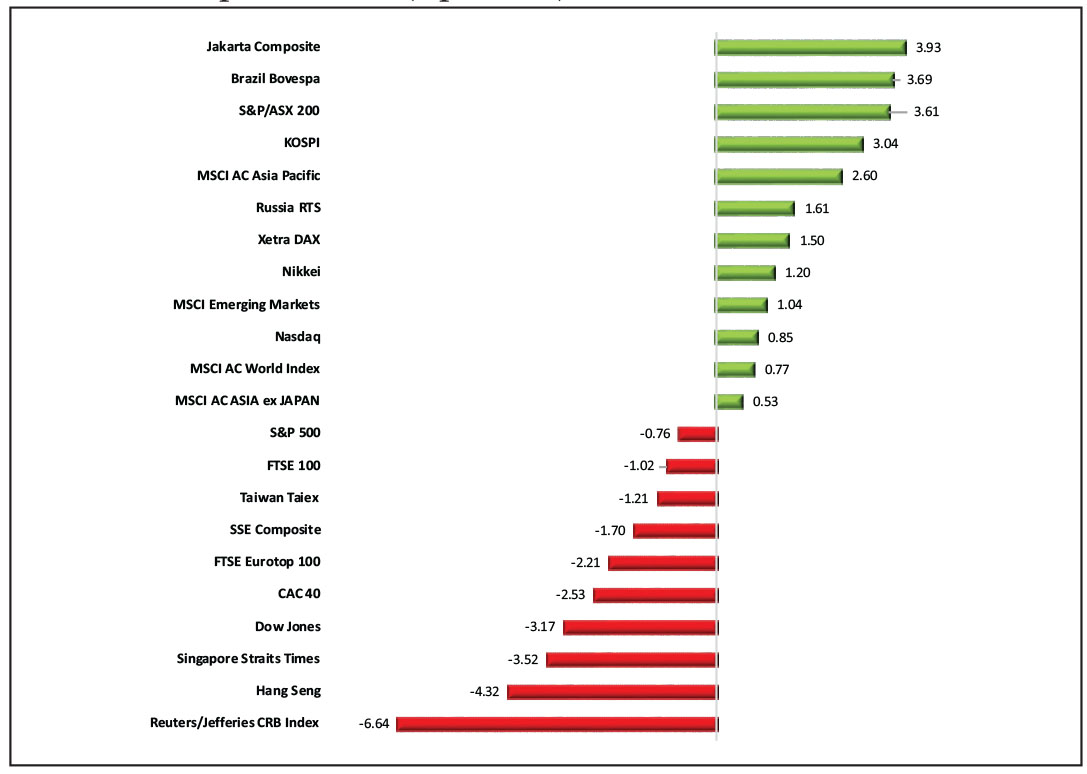

Global market performance (Quarter Ended June 2025)

Global markets experienced heightened volatility during the April – June 2025 quarter, largely stemming from trade policy uncertainty and conflict in the Middle East. The U.S. administration responded by suspending reciprocal tariffs for 90 days and laying the groundwork for a trade agreement with China. These developments helped restore investor confidence, leading to a rebound in risk assets. U.S. equities, particularly in the technology and artificial intelligence sectors, saw strong gains. Nasdaq climbed 18%, propelled by the 'Magnificent 71' and encouraging corporate earnings. European markets gained from a shift in global investment flows, heightened anticipation of increased defense spending, and supportive regional cues, with the DAX2 advancing by 7.8%. Meanwhile, Chinese markets were buoyed by the temporary trade deal but remained constrained by persistent weakness in domestic economic data, which continued to weigh on investor sentiment.

1 Magnificent 7 includes the stocks of Apple, Microsoft, Google parent Alphabet,

Amazon.com, Nvidia, Meta Platforms and Tesla

2 DAX is a stock market index consisting of 40 major German blue chip companies trading on

the Frankfurt Stock Exchange

Domestic Market Performance (Quarter Ended June 2025)

Domestic equity markets for the April – June 2025 quarter were initially unsettled by tariff-related uncertainties and geopolitical tensions, particularly the India-Pakistan and Israel-Iran conflicts during the quarter. Although these events triggered temporary risk aversion, the announcement of a ceasefire helped restore investor confidence. The resilience of the markets was further underpinned by robust macroeconomic indicators, supportive government policies and sustained foreign portfolio investor activity. The Reserve Bank of India's (RBI) decision to frontload a 50-basis point rate cut to provide timely support for economic growth exceeded expectations. In June 2025, Nifty gained 3.1%, while Nifty Midcap 150 and Nifty Smallcap 250 rose by 4.1% and 5.5%, respectively.

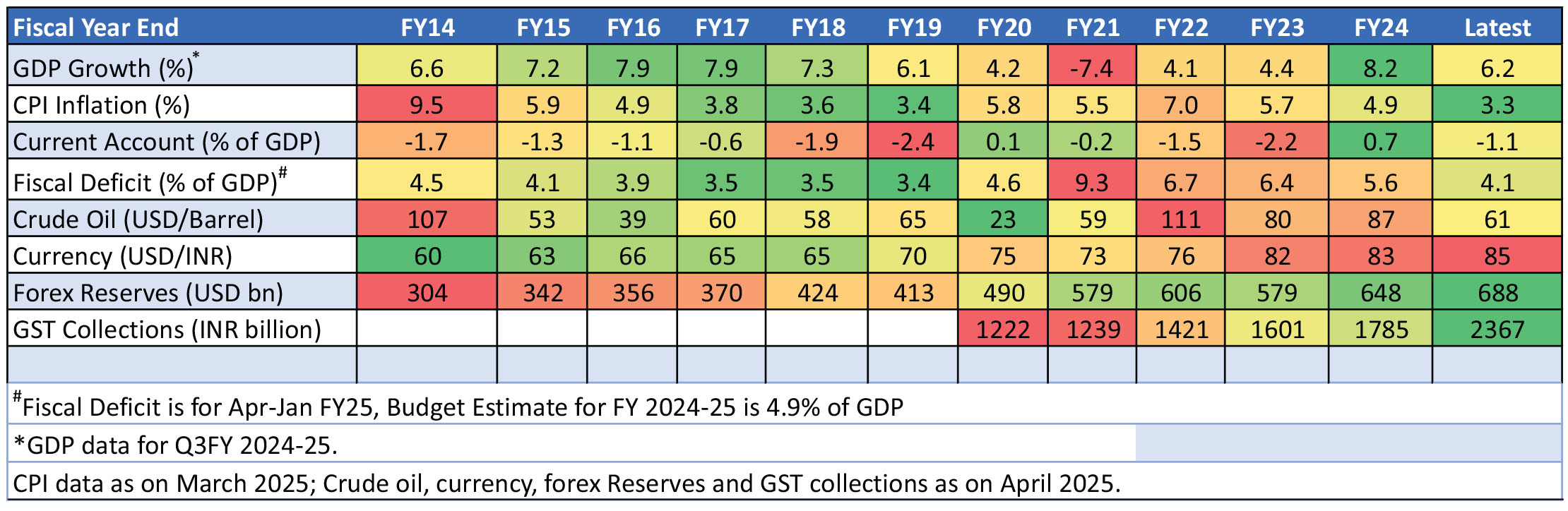

Macroeconomic indicators:

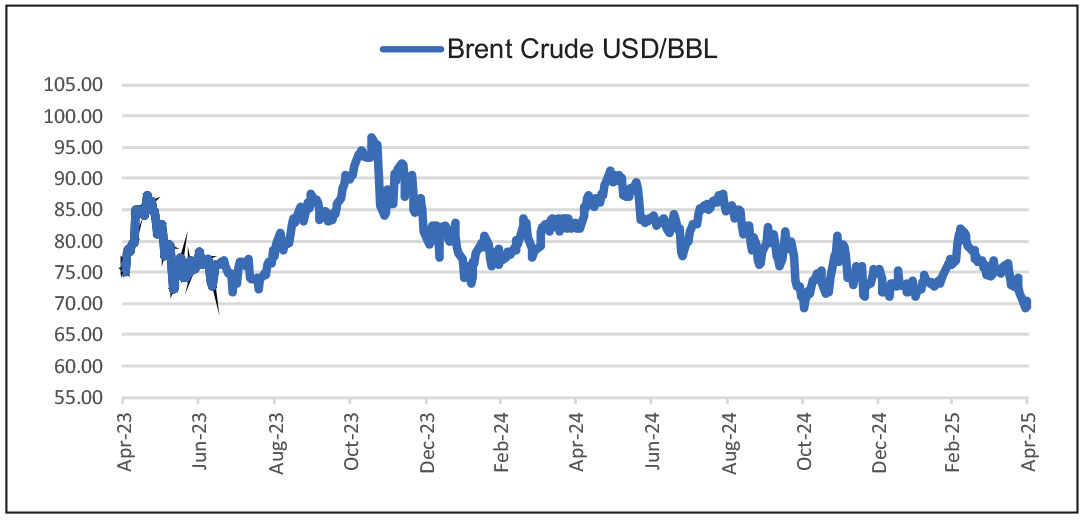

Crude oil prices – Brent

The war between Iran and Israel temporarily pushed Brent crude to an intraday high of $80 per barrel. However, prices later subsided following a ceasefire and the announcement of increased Organization of the Petroleum Exporting Countries production, which dragged oil prices down to around $67.

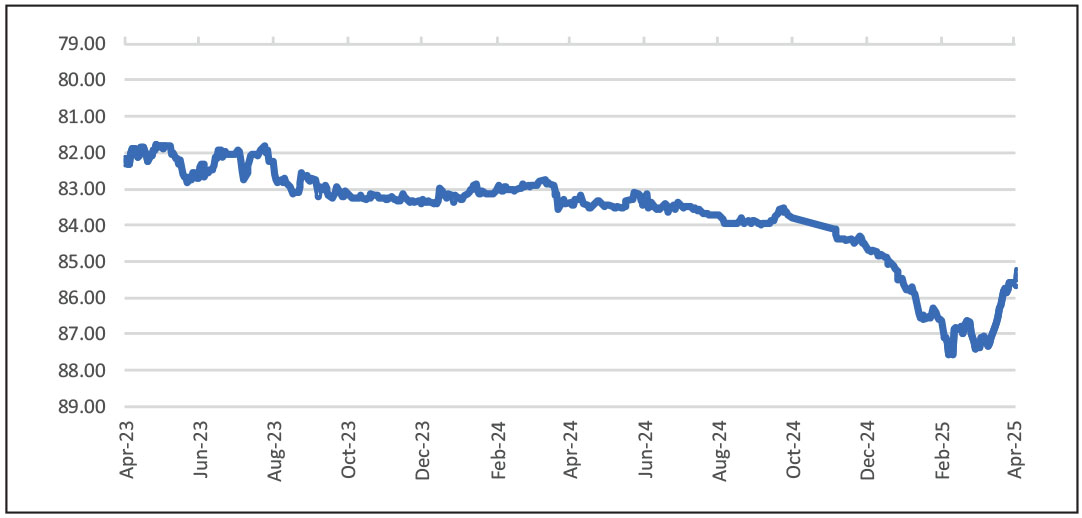

USD INR

The Rupee weakened marginally by 0.20% at INR 85.75 against the US Dollar in June 2025 vs May 2025.

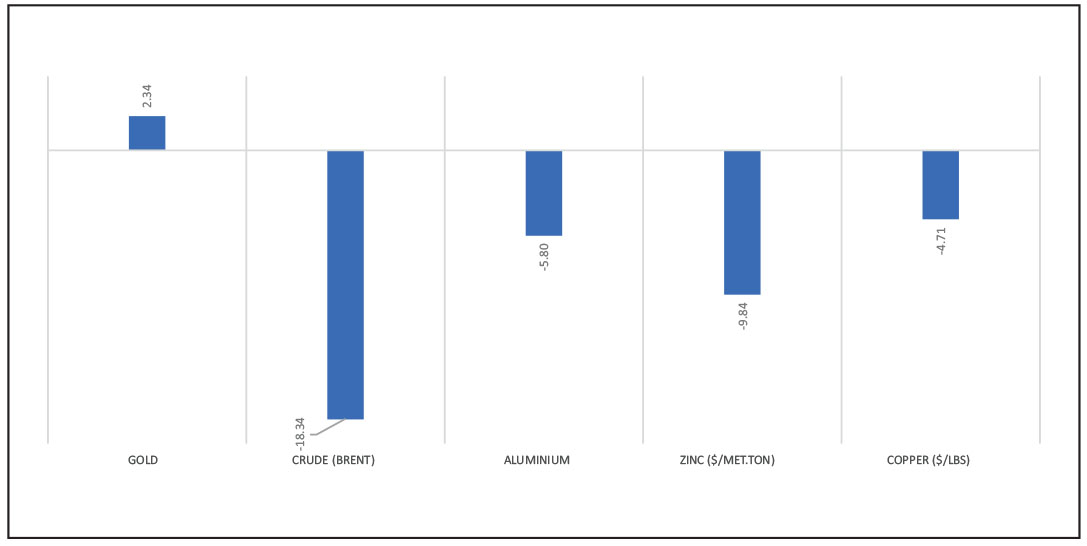

Commodity price trend

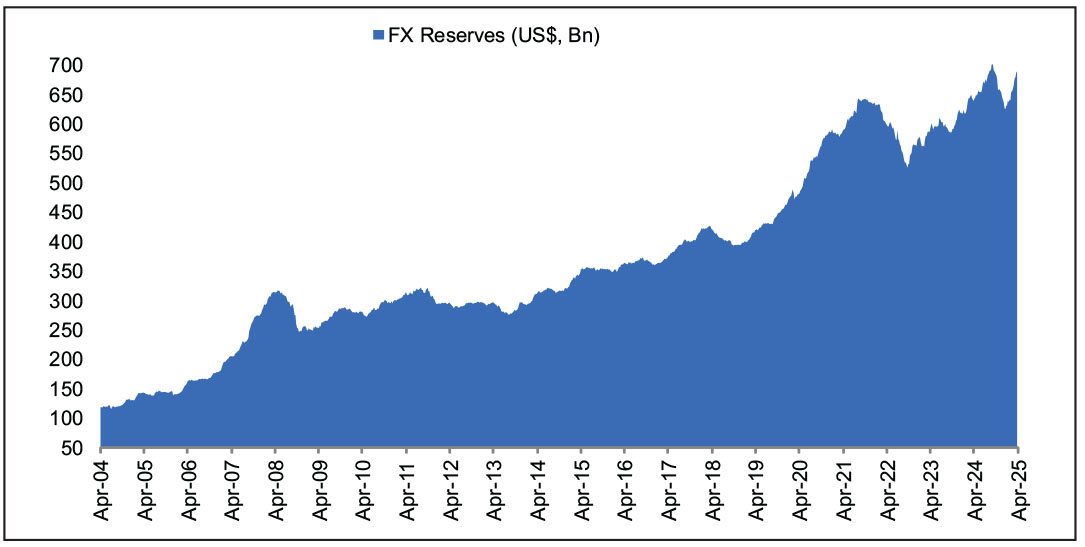

Forex reserves

India's foreign exchange reserves rose to $702.8 billion as of June 27, 2025, up from $691.5 billion on May 30, 2025. This reflects continued strength in the external sector, supported by robust services exports and remittance inflows.

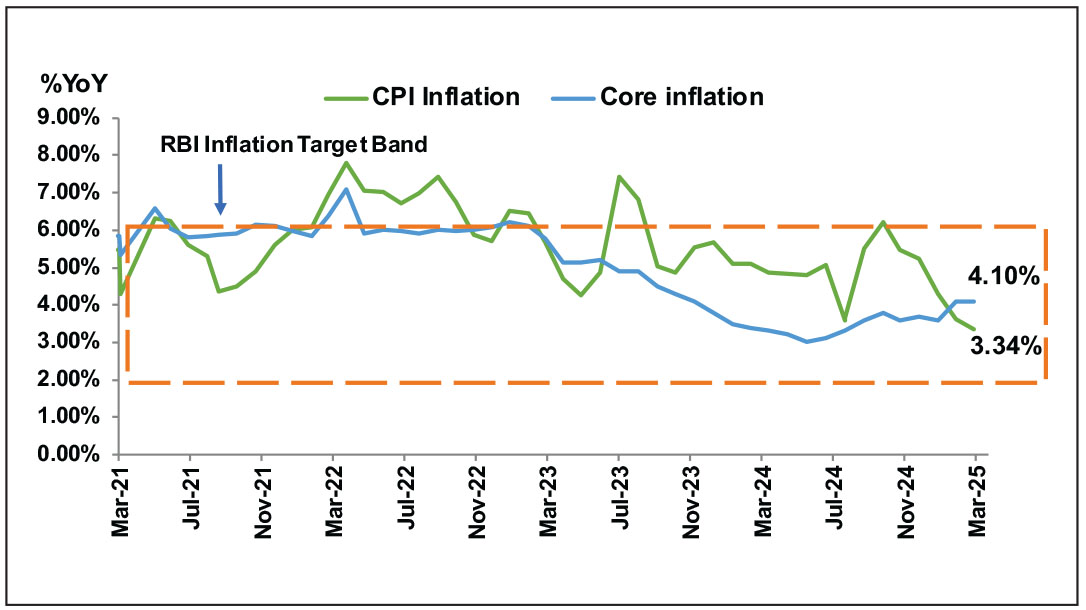

Inflation

India's headline CPI inflation moderated to 2.8% in May 2025, the lowest since February 2019, down from 3.2% in April 2025, largely due to softening food prices. Meanwhile, core inflation remained steady at 4.2%, with mixed trends across subcategories.

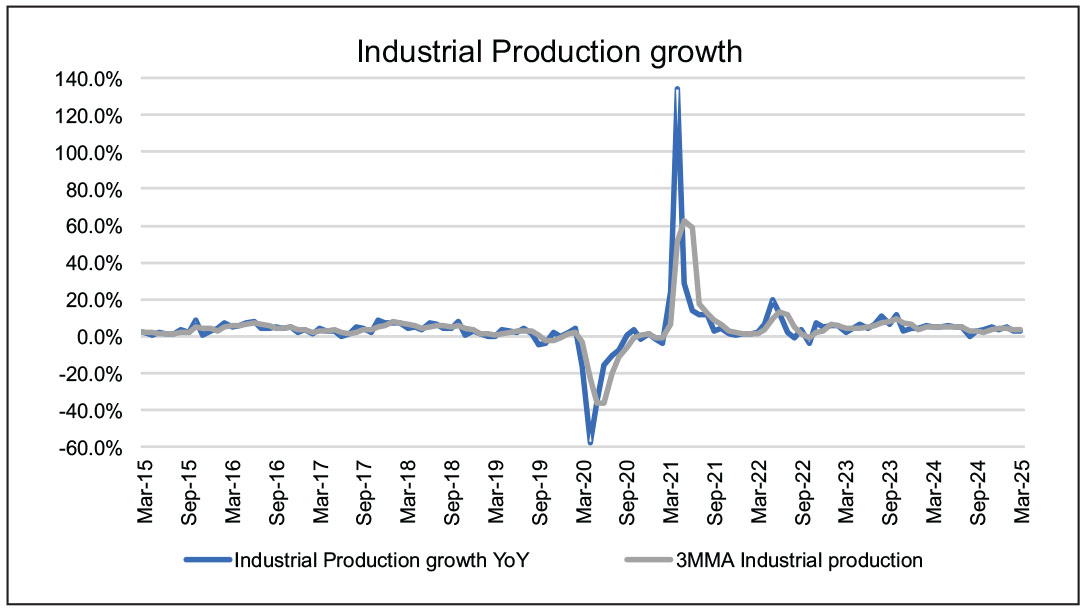

Industrial production

Industrial production moderated in May 2025, primarily due to a slowdown in manufacturing growth, along with declines in the mining and electricity sectors.

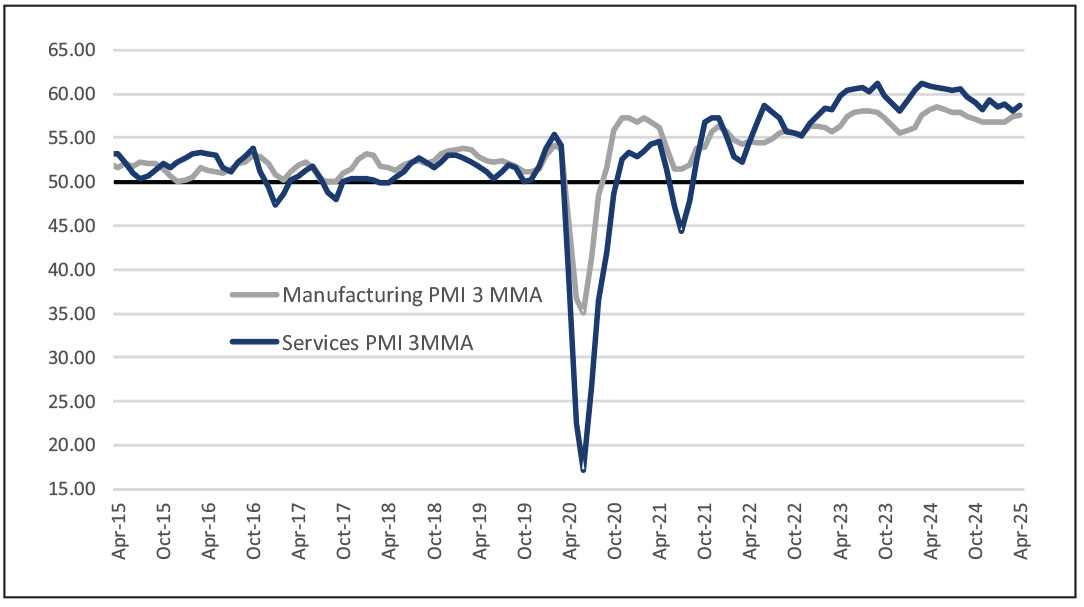

PMI Indicators

The Manufacturing Purchasing Managers' Index (PMI) expanded in June 2025, driven by robust demand supported by increased output and a rise in new orders from both domestic and international markets. The Services PMI also rose, reflecting an uptick in demand from global markets and resilient consumption within the domestic economy.

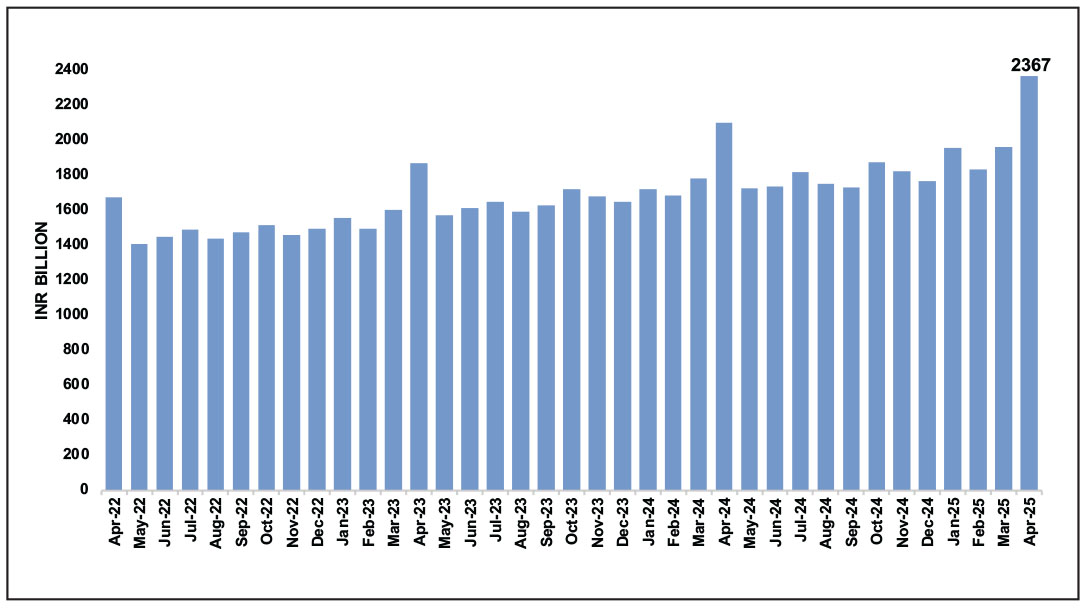

GST Collection

GST collections for June 2025 stood at INR 1.85 trn. Gross GST collections have shown sequential improvement to grow 6% YoY.

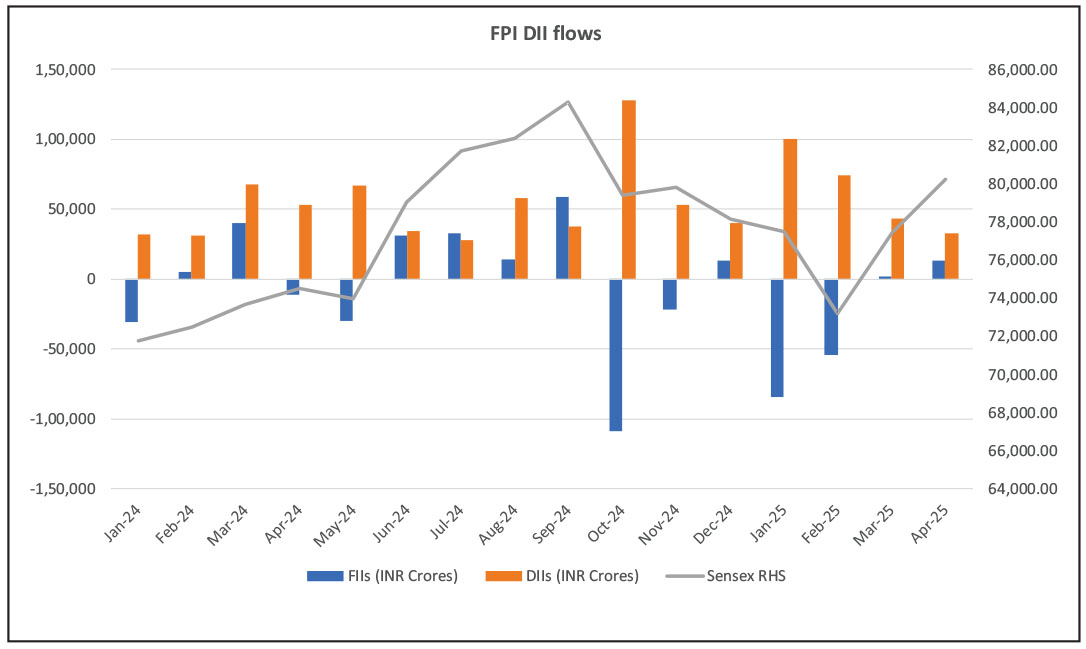

FII/DII equity flows

FIIs and DIIs were net buyers for the month.

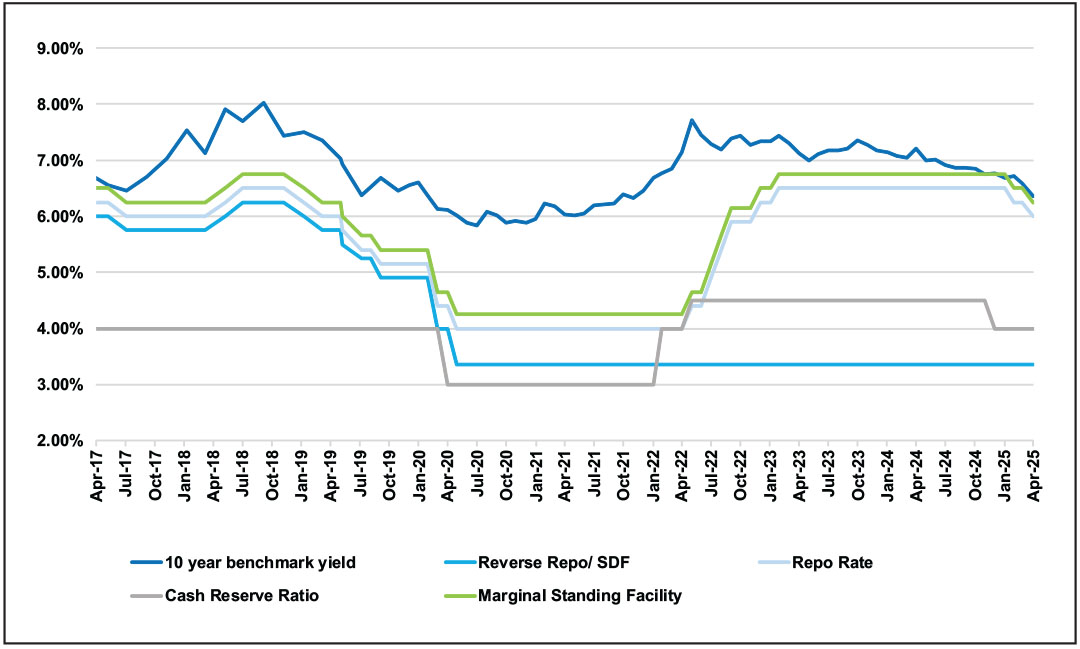

Domestic Interest rate trend

In its June 2025 monetary policy meeting, the RBI delivered a larger-thanexpected

50 basis point rate cut, bringing the policy rate down to 5.5%. It also

shifted its stance from accommodative to neutral and is expected to now closely

monitor data and outlook to balance growth and inflation effectively.

In its June 2025 monetary policy meeting, the RBI delivered a larger-thanexpected

50 basis point rate cut, bringing the policy rate down to 5.5%. It also

shifted its stance from accommodative to neutral and is expected to now closely

monitor data and outlook to balance growth and inflation effectively.Domestic Liquidity Conditions

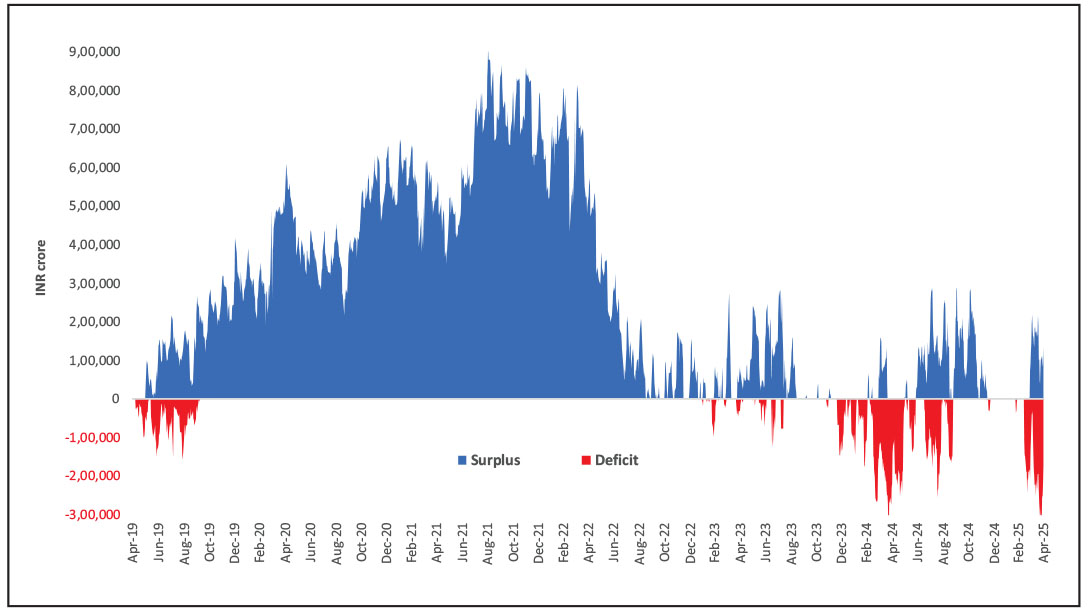

System liquidity remained in surplus of INR 2.74 lakh crores in June 2025, supported by RBI's active liquidity management.

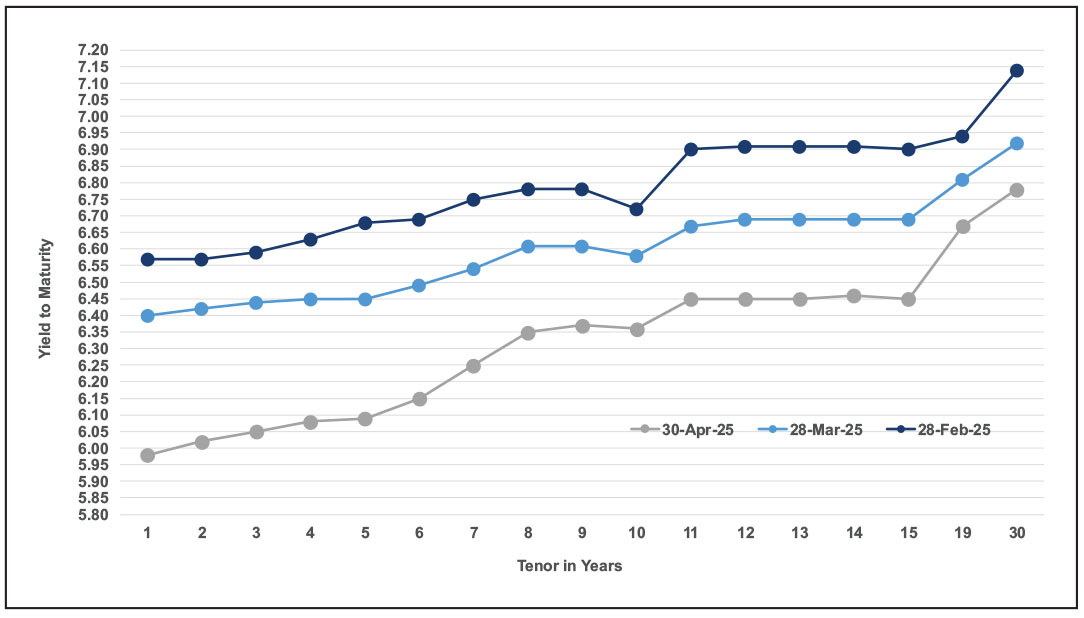

Yield Curve

India's 10-year bond yield rose by 4 basis points in June 2025 to 6.32%, reversing the softening seen in May 2025. The marginal uptick reflects fading expectations of further monetary easing.

Domestic Macros Heatmap

Source: Bloomberg, RBI, MOSPI, Morgan Stanley