Templeton India Value Fund

As on June 30, 2025

|

Templeton India Value Fund

As on June 30, 2025 |

|

|

TYPE OF SCHEME

An open ended equity scheme following a value investment strategy

SCHEME CATEGORY

Value Fund

SCHEME CHARACTERISTICS

Value Investment Strategy (Min 65% Equity)

INVESTMENT OBJECTIVE

The Investment objective of the scheme is to provide long-term capital appreciation to its Unitholders by following a value investment strategy

DATE OF ALLOTMENT:

September 10, 1996

FUND MANAGER(S):

Ajay Argal (w.e.f December 1, 2023) & Rajasa Kakulavarapu

BENCHMARK:

Tier I - Nifty 500 Index#

Tier II - Nifty500 Value 50 Index

#The benchmark has been changed from

NIFTY500 Value 50 TRI to Nifty 500 Index

w.e.f. August 1, 2023.

EXPENSE RATIO#: 2.04%

EXPENSE RATIO# (DIRECT) : 0.88%

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

Different plans have a different expense

structure

An open ended equity scheme following a value investment strategy

SCHEME CATEGORY

Value Fund

SCHEME CHARACTERISTICS

Value Investment Strategy (Min 65% Equity)

INVESTMENT OBJECTIVE

The Investment objective of the scheme is to provide long-term capital appreciation to its Unitholders by following a value investment strategy

DATE OF ALLOTMENT:

September 10, 1996

FUND MANAGER(S):

Ajay Argal (w.e.f December 1, 2023) & Rajasa Kakulavarapu

BENCHMARK:

Tier I - Nifty 500 Index#

Tier II - Nifty500 Value 50 Index

#The benchmark has been changed from

NIFTY500 Value 50 TRI to Nifty 500 Index

w.e.f. August 1, 2023.

| TURNOVER: | |

| Portfolio Turnover | 24.63% |

| VOLATILITY MEASURES (3 YEARS): | |

| Standard Deviation | 3.86% |

| Beta | 0.75 |

| Sharpe Ratio* | 1.45 |

| * Annualised. Risk-free rate assumed to be 5.52% (FBIL OVERNIGHT MIBOR) | |

# The above ratio includes the GST on Investment Management Fees. The rates specified are the actual expenses charged as at the end of the month. The above ratio also includes, proportionate charge in respect sales beyond T-30 cities subject to maximum of 30 bps on daily net assets, wherever applicable. MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTORS:

Rs 5000/1 MINIMUM INVESTMENT FOR SIP

Rs 500/1 ADDITIONAL INVESTMENT/

MULTIPLES FOR EXISTING INVESTORS:

Rs1000/1 LOAD STRUCTURE:

| Entry Load | : | Nil |

| Exit Load (for each purchase of Units) | : | In respect of each purchase of Units - 1% if the Units are redeemed/switched-out within one year of allotment |

NAV AS OF JUNE 30, 2025

| Growth Plan | Rs727.7990 |

| IDCW Plan | Rs104.1579 |

| Direct - Growth Plan | Rs811.2785 |

| Direct - IDCW Plan | Rs119.7888 |

| As per the addendum dated March 31, 2021, the Dividend Plan has been renamed to Income Distribution cum capital withdrawal (IDCW) Plan with effect from April 1, 2021 | |

| FUND SIZE (AUM) | |

| Month End | Rs 2298.64 Crores |

| Monthly Average | Rs 2248.23 Crores |

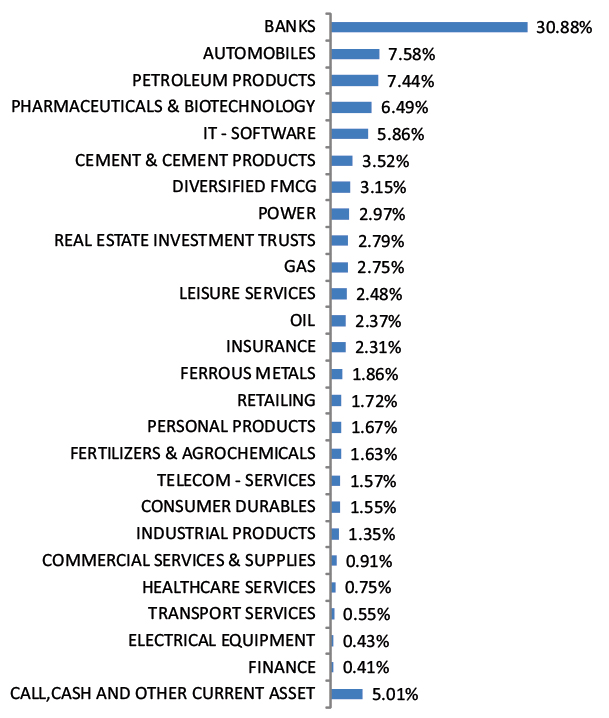

| Company Name | No. of shares | Market Value Rs Lakhs | % of assets |

| Agricultural, Commercial & Construction Vehicles | |||

| Ashok Leyland Ltd | 10,00,000 | 2,509.10 | 1.09 |

| Automobiles | |||

| Maruti Suzuki India Ltd* | 63,000 | 7,812.00 | 3.40 |

| Hyundai Motor India Ltd* | 2,75,000 | 6,104.18 | 2.66 |

| Tata Motors Ltd | 5,65,000 | 3,887.20 | 1.69 |

| Banks | |||

| HDFC Bank Ltd* | 9,50,000 | 19,014.25 | 8.27 |

| Axis Bank Ltd* | 11,00,000 | 13,191.20 | 5.74 |

| ICICI Bank Ltd* | 8,00,000 | 11,566.40 | 5.03 |

| State Bank of India | 7,25,000 | 5,947.54 | 2.59 |

| City Union Bank Ltd | 25,00,000 | 5,467.75 | 2.38 |

| IndusInd Bank Ltd | 5,00,000 | 4,360.50 | 1.90 |

| Kotak Mahindra Bank Ltd | 2,00,000 | 4,327.00 | 1.88 |

| Bandhan Bank Ltd | 19,00,000 | 3,603.16 | 1.57 |

| DCB Bank Ltd | 21,00,000 | 3,049.20 | 1.33 |

| RBL Bank Ltd | 1,41,910 | 352.62 | 0.15 |

| Cement & Cement Products | |||

| Grasim Industries Ltd | 1,25,000 | 3,555.63 | 1.55 |

| JK Lakshmi Cement Ltd | 3,60,516 | 3,242.66 | 1.41 |

| Commercial Services & Supplies | |||

| Teamlease Services Ltd | 1,05,000 | 2,132.76 | 0.93 |

| Consumer Durables | |||

| Akzo Nobel India Ltd | 60,000 | 2,049.18 | 0.89 |

| Crompton Greaves Consumer Electricals Ltd | 3,00,000 | 1,065.45 | 0.46 |

| Diversified Fmcg | |||

| ITC Ltd* | 16,00,000 | 6,663.20 | 2.90 |

| Electrical Equipment | |||

| Elecon Engineering Co Ltd | 2,00,000 | 1,309.40 | 0.57 |

| Ferrous Metals | |||

| Tata Steel Ltd | 25,00,000 | 3,994.00 | 1.74 |

| Fertilizers & Agrochemicals | |||

| UPL Ltd | 5,00,000 | 3,306.25 | 1.44 |

| UPL Ltd - Partly Paid | 50,000 | 215.33 | 0.09 |

| Finance | |||

| TVS Holdings Ltd | 10,000 | 1,095.50 | 0.48 |

| Gas | |||

| GAIL (India) Ltd | 15,00,000 | 2,862.60 | 1.25 |

| Gujarat State Petronet Ltd | 6,00,000 | 1,977.30 | 0.86 |

| Healthcare Services | |||

| Metropolis Healthcare Ltd | 1,00,000 | 1,706.20 | 0.74 |

| Industrial Products | |||

| Kirloskar Oil Engines Ltd | 3,89,910 | 3,318.33 | 1.44 |

| Insurance | |||

| ICICI Prudential Life Insurance Co Ltd | 8,50,000 | 5,592.15 | 2.43 |

| IT - Software | |||

| HCL Technologies Ltd | 3,50,000 | 6,050.10 | 2.63 |

| Infosys Ltd | 3,00,000 | 4,805.40 | 2.09 |

| Tata Consultancy Services Ltd | 65,000 | 2,250.30 | 0.98 |

| Leisure Services | |||

| Sapphire Foods India Ltd | 10,00,000 | 3,288.00 | 1.43 |

| Restaurant Brands Asia Ltd | 23,50,000 | 1,939.93 | 0.84 |

| Oil | |||

| Oil & Natural Gas Corporation Ltd* | 25,00,000 | 6,105.25 | 2.66 |

| Personal Products | |||

| Emami Ltd | 8,00,000 | 4,572.80 | 1.99 |

| Petroleum Products | |||

| Reliance Industries Ltd* | 9,50,000 | 14,255.70 | 6.20 |

| Bharat Petroleum Corporation Ltd | 12,00,000 | 3,983.40 | 1.73 |

| Pharmaceuticals & Biotechnology | |||

| Cipla Ltd* | 5,00,000 | 7,529.50 | 3.28 |

| Dr. Reddy's Laboratories Ltd | 3,00,000 | 3,849.90 | 1.67 |

| Akums Drugs And Pharmaceuticals Ltd | 6,00,000 | 3,512.40 | 1.53 |

| Power | |||

| NTPC Ltd | 11,00,000 | 3,683.90 | 1.60 |

| Power Grid Corporation of India Ltd | 10,00,000 | 2,999.00 | 1.30 |

| Retailing | |||

| Indiamart Intermesh Ltd | 1,25,000 | 3,247.50 | 1.41 |

| Go Fashion India Ltd | 1,05,208 | 930.88 | 0.40 |

| Telecom - Services | |||

| Indus Towers Ltd | 9,75,000 | 4,105.73 | 1.79 |

| Transport Services | |||

| Gateway Distriparks Ltd | 19,00,000 | 1,253.81 | 0.55 |

| Unlisted | |||

| HDB Financial Services Ltd @@ | 4,22,760 | 3,128.42 | 1.36 |

| Total Equity Holdings | 2,16,769.94 | 94.30 | |

| Real Estate Investment Trusts | |||

| Brookfield India Real Estate Trust* | 20,00,000 | 6,298.40 | 2.74 |

| Total Real Estate Investment Trusts | 6,298.40 | 2.74 | |

| Total Holdings | 2,23,068.34 | 97.04 | |

| Call,cash and other current asset | 6,795.36 | 2.96 | |

| Total Asset | 2,29,863.70 | 100.00 | |

| @@ Awaiting Listing | * Top 10 holdings | ||

@ Reverse Repo : 1.88%, Others (Cash/ Subscription receivable/ Redemption payable/ Receivables on sale/Payable on Purchase/ Other Receivable / Other Payable) : 1.08%

Please click here for Product Label & Benchmark Risk-o-meter.